When we do this, we see that both brokers offer competitive spreads. In fact, both IC Markets and AxiTrader offer spreads that are equal to or lower than the industry average for every forex pair. This shows that while IC Markets may be the cheaper option, AxiTrader is also a cost-effective choice. Between 74-89% of retail investor accounts lose money when trading CFDs.

AxiTrader UK Review

You can get it for free when you open a live account and deposit a minimum of at least $1,000. For instance, their average spread for EUR/USD is often below 1 pip. This competitive pricing structure is one of the reasons many traders prefer them. For a more detailed comparison on spreads and commissions, axitrader review you can check out this comprehensive guide on low commissions. IC Markets, known for its trader-friendly policies, has always aimed to make trading accessible to the masses. Their minimum deposit reflects this ethos, ensuring that even novice traders can start without a hefty initial investment.

Axi (AxiTrader) Review 2023 – The Good and the Bad

Having navigated diverse forex brokers, Jason shares his insights at Brokersway to bridge the gap between traders and the right brokerage. Hello to everyone.Forexbrokerslab is my personal blog where I review reliable forex brokers. Forexbrokerslab is a project that aims to educate and protect forex traders. In this blog you’ll find practical guidance, unbiased reviews and much more. If you were looking for more options concerning trading platforms, you can check my top forex brokers list to choose the best option for you. If you have any questions, feel free to leave me a comment and I’ll get back to you.

- By 2016 Axitrader has reached over €100bln in monthly volume, mainly from its original markets, as well as Germany, Latin American and Middle-East.

- Open direct channels of communication with professional traders and highly experienced analysts, then trade alongside them as they take on the markets every day.

- And so, Axi is making sure that when you’re trading, you’d have the supporting and appropriate regulations for your region.

- This probably won’t be required by the average day trader but if you are using a strategy that needs the lowest spreads and quickest execution possible, this could be a solution.

Axi Full Review

It can send you notifications when a pattern is discovered and identifies possible support and resistance levels based on these patterns. Compared to similar competitors, Axi has a great base currencies offering. Remember the risk of trading Forex & CFD – it’s one of the riskiest forms of investment. Average spreads may vary as they haven’t been updated since December 2016.

replies on “AxiTrader Review 2023”

Trading in forex, stocks, cryptocurrencies, CFDs, indices, and commodities carries the potential for financial loss and may not be suitable for all investors. Moreover, losses in leveraged products may exceed your initial deposit. We built the website to assist forex traders in finding the right forex brokers to trade with ease.

Lower Minimum Deposit: Tie

Besides competitive trading costs, Axi offers traders the third-party trading analysis platform PsyQuation. It can help traders improve their performance, which I find an excellent tool. Axi also uses the PsyQuation score for its AxiSelect program, which funds talented traders with capital, a rare and unique feature. The standard account requires no minimum deposit, has variable spreads starting from just 0.4 pips and charges no commission. This account does not have the lowest spreads but on the plus side, there is no commission fee.

These brokers are required by law to keep your funds separate from their own operational money. So, even if the broker faces financial trouble, your money remains safe and untouched. In order to open an Islamic account with Axi, you need to get in touch with their customer support and request an account opening. The broker will request some proof and they’d have the right to accept or deny your request.

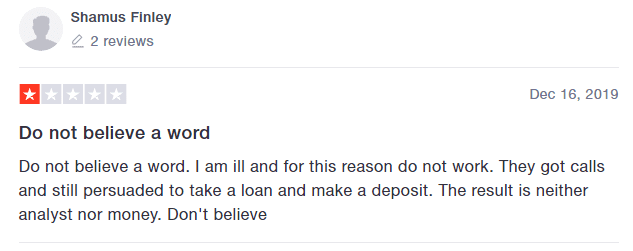

On a positive side, company’s reputation manager takes care of every query, which fosters a transparent discussion. Also, it was shown throughout this Axi trader review, that the funding methods are quite various where you get to choose the most suitable channel for you. Founded in 2007 with one big idea, to be the broker everyone would want to trade with. Once the broker put themselves in the traders’ shoes and starts thinking like one, it’s clear that that is a good broker to have on your side while investing. Which lead Axi to have a community of traders in around 100+ countries from all around the globe.

Axi UK must comply with the rules of the European Securities and Markets Authority (ESMA) when they are conducting their business. These rules limit the amount of leverage offered to EU clients and the way in which financial services are promoted. If you want higher leverage then you would need to look at the international brand. You will find stocks of the largest companies, popular cryptos and major currency pairs. Axi is a reputable broker offering a solid amount of FX instruments, albeit a relatively small number of CFDs via it’s FCA and ASIC-regulated entities. For a full list of all of the CFDs on stocks and local indices, check their website Axi.com.

These accounts also work in case of the need to acquire new information or knowledge about the market. Both brokers have made it incredibly accessible for traders by setting their minimum deposit requirement at $0. This is a commendable move, ensuring that barriers to entry are minimal. When it comes to trust and regulation, both IC Markets and Axi have established themselves as reputable brokers in the industry. They are both regulated by prominent financial authorities, ensuring that traders’ funds and interests are safeguarded. Advanced Trading Tools is an enhancement tool offered for the MT4 IC Markets.

AxiTrader also offers automated trading signals via the Auto Trade feature in Myfxbook – a third-party service provider that also powers AxiTrader’s economic calendar. For it’s PRO accounts, the broker charges a $7.00 Round-Turn (RT) commission per standard lot (100k of the asset), for accounts in USD & AUD, and the equivalent in other currencies. For Standard account clients will pay no commissions which will be overset by spreads starting from 1 pip. The connection time was under a minute and account managers were professional, able to quickly answer both generic and more advanced questions. Yes, Axi operates as an Electronic Communication Network (ECN) forex broker, providing direct access to liquidity providers and offering competitive pricing and execution.

Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before https://forexbroker-listing.com/ evaluating the total trading costs. Axi offers a positive swap on EUR/USD short positions, meaning traders get paid money.

Below shows some of the key players at Axi who have one of the most experienced teams worldwide. The site navigation is very nice and offers the best graphical user interface, which makes it ideal for all forex traders. Their trading platforms extend MAC and Windows PC and mobile trading tools like smartphone devices such as the iPhone and Android phones and iPad and Android. Traders can make use of the Autochartist and Myfxbook Autotrade, which is a social-based trade community.