As rising cost of living features squeezed consumer budgets and you may family conversion process features plummeted over the past season, interest in Doing it yourself goods and you will larger, discretionary products possess refused, but so it recent trend sometimes opposite at some point and may just be an initial-name topic. Ceos both for businesses are still optimistic regarding the future of the brand new home-improve globe, citing the depend on on mind-set into mid-to-overall.

Money study put out recently getting Q2 had americash loans Carlton been a combined purse having the house-improvement monsters, surpassing standards in a few elements, and you may stagnating in other people. So it quarter, Lowe’s money defeat estimates , reporting money per show away from $cuatro.56, than the requested $cuatro.47. Their cash away from $25 mil was in range that have expert estimates. House Depot’s comparable sales towards quarter decrease 2% however, is much better than the brand new questioned step 3.9% miss. Online sales for companies became last one-fourth, upwards 1% getting Household Depot or over 6.9% having Lowe’s.

Regarding a broader macro perspective, home loan rates will still be increased, inflation enjoys cooled however, remains over the Fed address rates out of 2%, and you may consumers are still careful of its using. Into the late August, mortgage cost hit an excellent 23-seasons higher , and you may mortgage consult from homeowners consequently dropped to help you a twenty eight-seasons low. That have highest financial rates, the latest housing industry has a tendency to sluggish; credit can cost you increase, family value minimizes, and the new design refuses as well.

In addition, single-mortgage features are generally more complicated so you’re able to backfill with a new renter in the case the existing tenant is suffering from worst overall performance and works out supposed dark (vacating the area)

At exactly the same time, with a bigger portion of house income allotted to mortgage repayments, people be more cautious and you may expenses decreases. It was confirmed from the statements from your home Depot President , Ted Decker in a Q2 income release, stating that the business performed pick proceeded pressure in some big-admission, discretionary groups. Also, one another Lowe’s and Home Depot noticed a decrease in individual paying towards Do-it-yourself systems, more than likely due to such financial limitations.

Home Depot and you will Lowe’s both possess a substantial CMBS footprint round the some possessions types. Already, Family Depot have $3.96 mil across the 75 finance during the total exposure, and you can Lowe’s has actually $1.57 million give around the 53 loans.

Monetary results of these finance is fairly healthy full, which have Domestic Depot post an effective Adjusted Average DSCR (NOI) out-of 2.41, and Lowe’s post a two.05. Lowe’s enjoys much more shopping coverage, using its shopping balance bookkeeping for 84% of one’s overall. House Depot’s shopping balance is the reason 53% away from full publicity, that have mixed-explore and you can industrial characteristics symbolizing twenty eight% and you will sixteen% respectively. The next pie charts diving actually higher, breaking down tenant exposure by the possessions subtype.

Single renter features take into account 2.9% from Family Depot’s balance, and you can 6.9% away from Lowe’s. Because of the current macroeconomic conditions, this subtype is very interesting, as their base site visitors is actually solely determined by the users likely to search for family-improvement goods.

As a result, actually single-tenant features rented so you can resource-values clients expose particular exposure, especially for highest domestic-improvement qualities which can be tough to reconfigure for one or more this new tenants otherwise has actually a highly minimal pond of tenants that you certainly will backfill the complete area just like the-is with restricted return pricing. Thus, inside a period in which costs was higher and you will lower turnover in the the brand new housing marketplace try making the pressure toward home improvement stores, single-tenant features is actually good subtype to watch because their show are quite digital.

No matter if a store is wanting to slice underperforming places and you will an individual-occupant property is toward checklist, the best-situation scenario is that the fresh new tenant’s rent still has five or even more many years left so as that there can be nonetheless cash to coverage the brand new loan’s personal debt services and you can plenty of time to hopefully secure another type of tenant to backfill the room. Out of mortgage performance towards the a few tenants, consider the fresh desk less than.

In the event Lowe’s full coverage is 40% of Domestic Depot’s, the 2 has an about equivalent harmony getting solitary-renter services. Cashflow is quite fit for both, yet not, over a 3rd of every businesses solitary renter harmony is on Trepp’s watchlist.

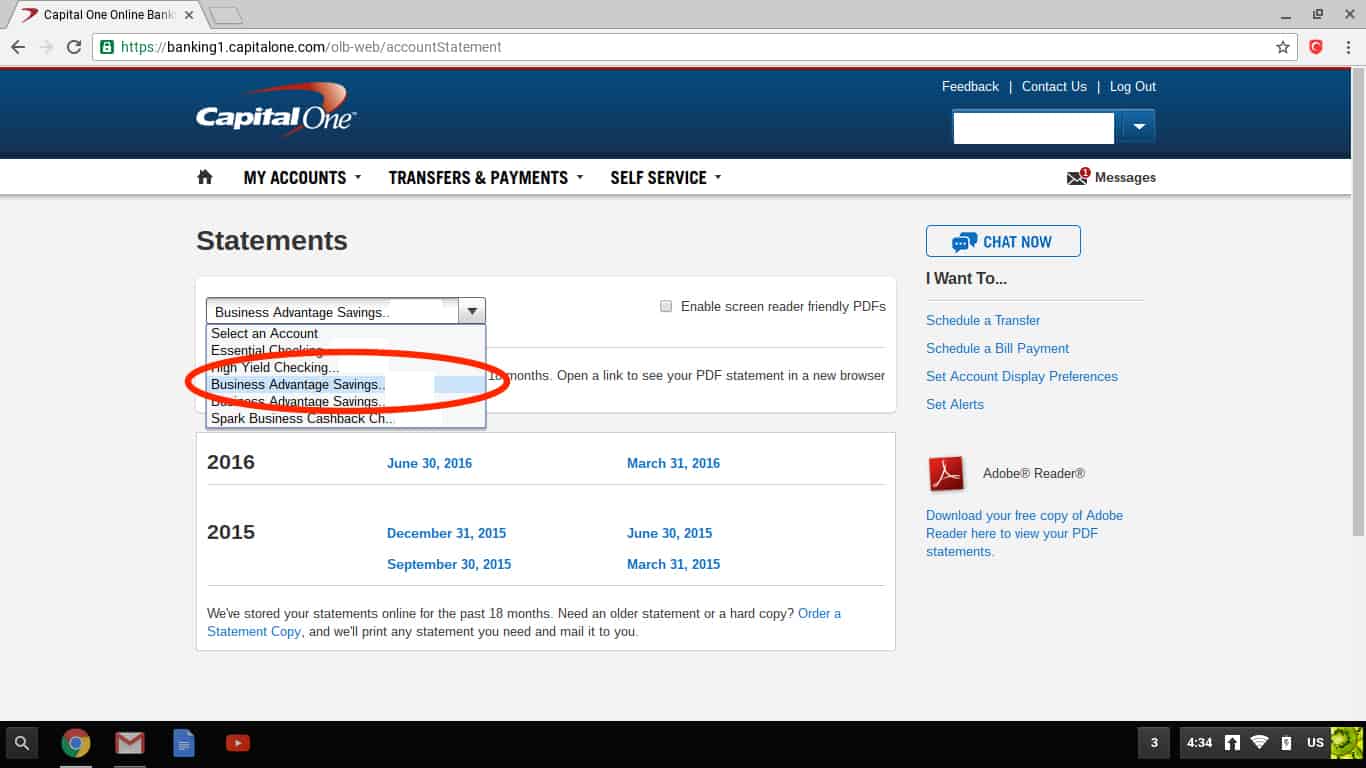

Using Trepp’s tenant publicity analysis, the team separated House Depot and you may Lowe’s money tied to CMBS to research for each and every retailer’s securitized mortgage footprint

Among subtypes, superregional malls create the greatest part of each other companies’ exposure, accounting having twenty eight.7% and you will 30.1% to own House Depot and you may Lowe’s respectively. So it comes out so you’re able to $step 1.14 million to possess House Depot and $487 billion getting Lowe’s. Because of it assets subtype, venue is vital, given that distance so you can residential elements assists drive up individual ft website visitors and you will spending. To have household-update people eg Family Depot and you may Lowe’s, housing turnover is essential as moving services was an important individual sector.

July investigation from the Federal Relationship away from Real estate professionals showed that present domestic sales dropped dos.2% week-over-week, and 16.6% seasons-over-12 months. With current house conversion decreasing, buyers turned to the home, and therefore sustained a great 4.4% increase in July good 17-week higher. That being said, the median brand new home rates fell 8.7% 12 months-over-year, the next-lower drop over the last three years. Trepp mortgage-top data facts this new details of individual services, discussing next throughout the superregional centers where Home Depot or Lowe’s are an occupant.

New Palisades Center Mall are a-1.9 billion sq ft giant located in West Nyack, Nyc, in which a house Depot ‘s the premier occupant which have 132,000 sqft. Most other higher renters is Target, BJ’s Wholesale Club and you can Dick’s Sports. The modern harmony supported by the entire shopping mall is higher than $400 billion and recently ran lower than foreclosures.

Kings Retail center is found in South Brooklyn, Ny, which will be a keen 811,000-square-base superregional shopping center where Lowe’s ‘s the biggest renter with 114,000 square feet . Next biggest renters try Primark, Burlington Coating Factory, and best Buy. The current harmony into the mortgage was $487 million and grows up from inside the 2030, DSCR (NOI) try strong in the 2.22, therefore the financing are latest on the money.

Current earnings getting Household Depot and you will Lowe’s color a blended visualize. Lowe’s surpassed Q2 money criterion, if you find yourself House Depot’s transformation decline was lower than asked. Although not, broader monetary points including highest financial costs and you will rising cost of living keeps impacted the housing market and you may individual using, since present in Family Depot’s Q2 efficiency. One another organizations features generous CMBS visibility, with the solitary-renter characteristics send match financials and you may large footprints throughout the tough-struck superregional mall subtype.

Superregional malls, a serious property kind of both for, depend on venue and you will housing ics. Recent manner home based sales stress proximity’s pros.

Trepp studies features knowledge, for instance the Palisades Center Mall and you will King’s Mall. Given that Domestic Depot and Lowe’s browse that it dynamic landscaping, its abilities relies on functional procedures, financial trends, housing figure, and you may merchandising transform. Stakeholders is closely check out these types of products getting knowledge into their future candidates.