To your , plaintiff’s counsel sent for the court a proposed purchase explaining brand new regards to the latest payment contract. Plaintiff’s guidance implemented upon so it efforts from inside the a letter delivered in order to defendant 2 days later and then he verified “you to a cards modification has been taken to the credit agencies to improve the newest revealing of one’s due to monthly home loan payment(s).”

Offender blogged towards the legal to your , objecting into the recommended payment buy. Offender informed the new court which he asked “a relationship” out of Arizona Shared “to the effective elimination of the [sic] negative revealing.” Accused finished the brand new page because of the emphasizing that “as to what suggested time, this has for ages been my position that it requires sixty days regarding the elimination of the fresh bad revealing to re-finance the functions.step one This can be according to getting brand new appraisals and finishing the fresh loan techniques.”

Within the a page to your court old , plaintiff’s the recommendations mentioned that defendant’s updates wasn’t similar to the regards to the fresh new payment wear the number to the . The recommendations argued one to within the settlement agreement Arizona Mutual was just forced to “take-all sensible methods to correct [defendant’s] credit scoring.” The advice concluded this new letter by the concentrating on one just like the financial “usually do not control what those companies sooner do with the information,” few other “certain promises will be $255 payday loans online same day Massachusetts generated”

On , offender transferred to put the circumstances for the dead list, vacate the new payment acquisition, and have the courtroom get into a unique buy highlighting defendant’s expertise of the terms of this new settlement. New legal read oral disagreement on the motion towards ,2 and you can refused the fresh recovery expected for the your order old . The latest legal inserted Final Wisdom out-of Foreclosure into ount owed of defendant during the time because $step three,558,, and additionally interest accruing, and you may awarding plaintiff $seven,five-hundred for the counsel fees pursuant so you’re able to Signal 4:42-9(a)(4).

Toward , accused, through the advice, registered a movement to have reconsideration of your own buy. Through this time yet another court is allotted to this new situation. The fresh new judge read thorough dental argument toward action to the . After this hearing, the brand new courtroom directed plaintiff’s the advice to incorporate accused having documentary proof one Arizona Shared had contacted the financing organizations as required by the the latest settlement contract.

Plaintiff’s guidance objected to what the guy thought of try a mere decelerate tactic of the offender. Counsel’s colloquy with the courtroom contains stating verbatim right here, because caught new frustration experienced of the all of the users from the extensive activity habit generated by an ostensibly compensated dispute.

Regarding the skills showed in support of the brand new motion, defendant continued in order to maintain that their credit rating had not been corrected

PLAINTIFF’S The recommendations: Your Honor welcome that activity. I never first got it. That it motion happens to be framed regarding vacate the brand new payment, to not impose. And that is everything i responded to. Your Prize welcome that over after and you can we have today had around three moves, the first you to definitely, another you to definitely and today new reconsideration you to definitely. Plus they every say a similar thing and not one of them attempt to impose the brand new payment. And i also responded to the fresh activity that was filed.

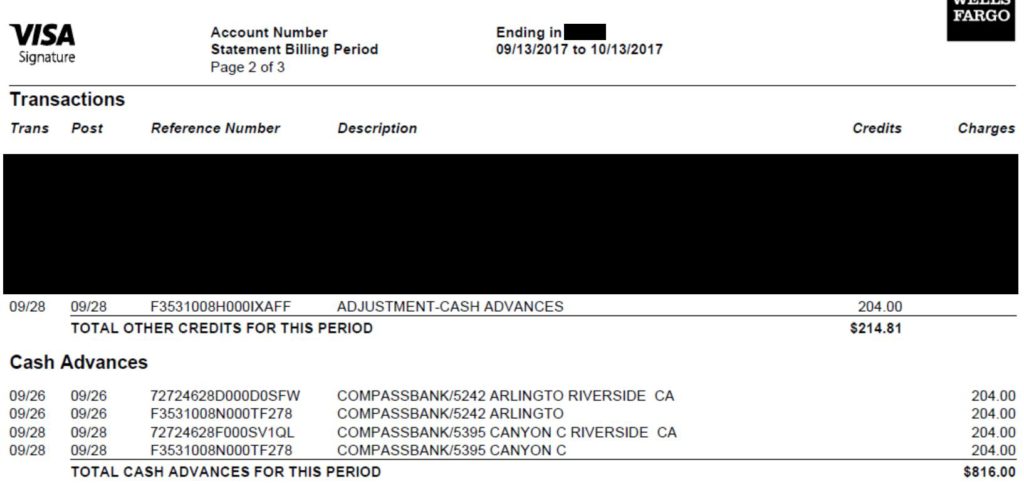

According to their degree, into , the guy hand-brought to the latest courtroom a supposed content away from their credit file exhibiting one Arizona Shared hadn’t fixed the so-called credit mistakes

PLAINTIFF’S The recommendations: Whether your bank failed to would exactly what it offered to create, up coming arguably Your Prize, inside an order in order to demand this new payment, perform tell me to return and then have my client manage what it had a need to create. Then I guess the newest clock create start powering once more . . . .