The latest get back from 100% mortgages might have been recognized in an effort to let beleaguered basic-big date buyers score on the assets hierarchy, plus one really obvious income recently had lower as the Barclays keeps reduce rates on the the 100% guarantor mortgage.

This new bank’s 100% Loved ones Springboard financial, and this doesn’t need the fresh debtor to place off in initial deposit, now has a lower life expectancy rates off dos.95% of 3% in the past. This will make it less expensive than large-street competition Lloyds Bank, hence revealed a similar contract earlier this seasons .

it makes the price less expensive than of many 95% loan-to-well worth (LTV) mortgages, and this need buyers to put off in initial deposit with a minimum of 5%.

Mortgage loans letting you borrow 100% off an effective property’s value was basically considered become a primary factor on the property drama off 2008, however, over 10 years later, are they worthwhile considering?

Hence? explores new 100% home loan field, and you will teaches you the benefits and dangers of the brand new debatable finance, with viewed a revival in 2010.

Be more currency savvy

It publication provides free money-relevant blogs, together with other facts about And this? Classification products and services. Unsubscribe at any time. Important computer data could well be processed prior to our Privacy policy

What is actually an excellent 100% home loan?

Good 100% financial is actually a loan for the whole cost away from good possessions, and this doesn’t need the brand new debtor to spend a deposit.

However, they’d nonetheless probably have to pay to have stamp duty (though there was not one recharged so you’re able to earliest-day consumers purchasing services worthy of doing ?three hundred,000), including home loan and you may courtroom charge, therefore the cost of property questionnaire .

While they are referred to instant same day payday loans online Georgia as ‘ 100% mortgages ‘, the latest sales usually require a pops or relative to act since the a great guarantor and are generally often called guarantor mortgages.

This building Communities Organization (BSA) recently asserted that loan providers should consider taking straight back new high-risk funds, which starred an associate throughout the 2008 economic freeze, to end buyers relying on their mothers.

How come Barclay’s 100% home loan work?

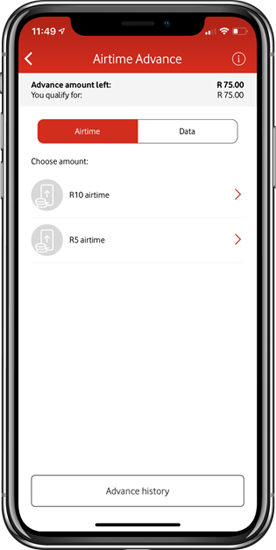

But it need a 10% put in the borrower’s parents, which can be returned after 36 months, provided the home loan repayments manufactured punctually.

Barclays pays dos.27% AER yearly of about three-12 months several months. In comparison, Lloyds Financial will pay dos.5% AER into the similar contract.

What forms of 100% mortgages arrive?

Typically, 100% mortgages are only available if you have a beneficial guarantor, usually a grandfather that will safety the mortgage for those who skip a fees.

- Get the full story:100% mortgage loans

100% mortgages: benefits and drawbacks

The advantage of a good 100% home loan is that you won’t need to look at the struggle out-of pull to each other in initial deposit to possess home financing.

And as much time because you meet all of your mortgage repayments, there isn’t any prices on the guarantor. They may be also advisable for those having lowest revenue, or that have a less than perfect credit history.

However, many therisk is towards guarantor, whom in many cases need set up their particular domestic given that protection to help you back the individual taking out fully the 100% mortgage. Because of this the latest guarantor’s family might be at stake when the the brand new debtor fails to build repayments.

Another important downside was negative collateral , in which you are obligated to pay more about their financial compared to the property is value. Having an excellent 100% financial, a dip throughout the possessions rates have a tendency to quickly mean the mortgage exceeds the worth of your property. Therefore of numerous loan providers are unwilling to offer 100% sale.

In the nearest and dearest offset home loan, the household user would not earn one attention to their coupons, while on a combined financial your family affiliate will need to spend stamp obligations from the extra rates and you may face capital growth tax costs.