An enthusiastic FHA area 203(k) mortgage enables you to possibly pick otherwise refinance a home and you will utilize the financial continues and work out required solutions. not, you might use only 203(k) fund for your primary home. However, due to the fact Government Housing Management guarantees these products, they truly are way more available to some consumers with credit otherwise money limits than other rehabilitation financing options.

FHA loans are usually thought of as getting designed for first-big date homeowners, however, this isn’t the only real target demographic. The new loans get allows you to create a down-payment given that lower since the step three.5%, and you can meet the requirements which have a reduced favorable credit history than simply certain conventional financing points. The lenders your FHA lets giving this type of fund make the last decision regarding debtor, however, as FHA backs the fresh new funds, there’s more room about financing guidance. However, by easy certification, all the FHA financing require debtor in order to maintain financial insurance because much time while they support the financing.

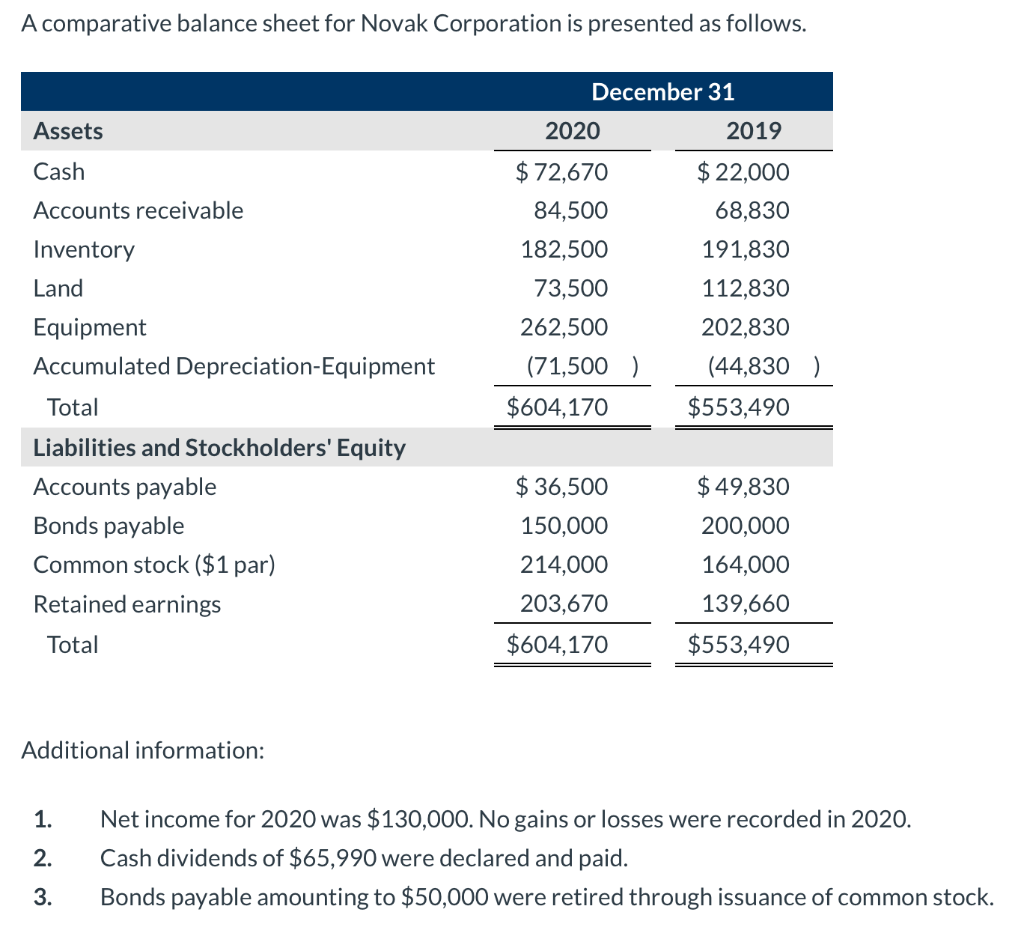

How much does a great 203(k) Mortgage Safeguards?

There are 2 brands of 203(k). The high quality peak vary from significant structural repairs on higher will cost you compared to smooth variation, which is simply for home improvements below $35,000. However, the fresh new borrower must have fun with a good HUD representative so you’re able to watch the method into huge restriction. 203(k) solutions and you may systems vary from this type of:

- Plumbing work and sewer systems

- Floor

- The means to access to possess handicapped someone

- Energy-results developments

- Land tactics

- Rooftop and roof-related repairs

- Elimination of safety and health problems

How can i Play with an enthusiastic FHA 203(k) Loan to own a residential property?

FHA financing products, including the 203(k) treatment finance, are only getting borrowers’ first homes. So it stipulation means that the sole genuine cure for have fun with you to to possess an investment property is to try to live-in a multi-product dwelling. Instance, you can use an effective 203(k) loan to evolve an effective duplex, triplex, otherwise quad if you reside in a single unit and you may rent (otherwise want to rent) others.

Imagine you use the new 203(k) to shop for a 4-equipment strengthening that requires solutions. You must reside in one to equipment for around 12 months. Upcoming, you could get-out and continue maintaining the credit unchanged if you require (you can find restrictions). Just remember that , you continue to pay mortgage insurance rates as long since you look after an FHA mortgage, so you might be interested in various other financing product whenever possible.

How to Score an effective 203(k) Financing?

Just as in almost every other FHA loans, the fresh new 203(k) demands at least downpayment out-of 3.5% of the cost. The most that you can acquire was 110% of the appraised value of the home. A debtor must have a credit score of at least 580 to qualify for a beneficial step 3.5% down payment, and many lenders want a higher still score and place a beneficial maximum debt-to-income ratio. Borrowers having less score ount. The necessity getting a beneficial HUD agent increases the project’s total will set you back however, brings supervision to help you assures the financial institution additionally the FHA your loans are increasingly being spent on the said goal.

You can find conventional mortgage program choices you can thought for those who have a top credit history or if you should build developments the FHA system excludes.

It material is actually for standard guidance and educational purposes just. Information is based on investigation gathered about what we think was reliable present. This is simply not secured concerning reliability, doesn’t purport is done which will be maybe not meant to be studied given that a primary reason behind money conclusion. All of the funded a property expenditures be able to own foreclosures.

Obtain our very own guide to home using

By providing their current email address and you can phone number, youre deciding to receive correspondence of Understood. If you receive a text and pick to eliminate acquiring then texts, answer Prevent to help you instantaneously unsubscribe. Msg & Research pricing can get use. To handle choosing emails out-of Knew visit the Create Needs connect in virtually any email address obtained.

Realized

- 400 W. fifteenth Path Suite 700 Austin, Colorado 78701

- (877) 797-1031

Contact us

Realized1031 was an online site manage by Know Technology, LLC, a wholly owned part regarding Realized Holdings, Inc. (Realized). Collateral ties provided on this website are offered solely courtesy Understood Economic, Inc., a registered agent/broker and you may person in FINRA/SIPC (“Know Economic”). Financing advisory features are given as a consequence of Knew Monetary, Inc. a subscribed resource agent. Knew Economic, Inc. are a part out-of Knew. Take a look at background for the firm toward FINRA’s BrokerCheck.

Hypothetical example(s) are to own illustrative aim merely and are maybe not meant to represent for the last or coming abilities of any certain resource.

Committing to solution assets concerns higher risks than just conventional opportunities and is acceptable simply for advanced traders. Option investment are often marketed from the prospectus one discloses all of the threats, charge, and expenses. They’re not taxation efficient and you may an investor will be speak with his/their taxation mentor prior to spending. Alternative opportunities have large fees than simply old-fashioned investment and additionally they may additionally be extremely leveraged and you may participate in speculative capital processes, that may magnify the chance of financial support losses otherwise obtain and you can really should not be considered an entire financial support system. The value of new resource get slip along with go up and you can traders might get straight back less than they spent.

This site are penned to possess customers of your own You whom was licensed buyers just. Joined Agencies and you can Capital Mentor Agencies might only do business which have customers of https://paydayloansconnecticut.com/woodmont/ your says and you can jurisdictions where he is properly inserted. Thus, a response to a request guidance could be delay up to compatible membership are obtained or difference regarding subscription is determined. Not all of qualities referenced on this web site appear in most of the state and you may courtesy all the user noted. To find out more, please contact 877-797-1031 otherwise