- Home loan Articles

- Home loan Charges Charge

To purchase a property is costly, so it is practical to reduce home loan fees and fees where you are able to. This new shorter you pay in home mortgage costs, the higher.

Of a lot homeowners are able to stop using some of these costs completely due to the fact lenders usually manage unique promotions with refinance and get rebates, no loan handling costs, free valuation etc. while some loan providers render discount rates in order to first home buyers and you may see pros.

step one. Charges payable on payment

- Financial app otherwise loan processing payment: This can be an effective immediately following-away from payment the financial institution may charge when you take-out a loan. So it fee varies between lenders however, fundamentally selections between $0 to $800.

- Valuation fee: After you have found property, the lender should possess a unique valuer create a great valuation on the property. Particular lenders will waive the new valuation payment, however they are far and also in between. It will rates as much as $300. We can purchase a free of charge initial valuation to you personally with of our loan providers.

- Payment otherwise facilities payment: Settlement commission is actually a charge payable on the bank to fund the price the bank incurs inside installing your loan. The Weogufka AL bad credit loan fee range between $0 so you’re able to $600 depending on the financial. For many who decide for a professional package, the fresh new settlement payment often is waived.

- Rates lock commission having fixed financing: Lenders commonly charge a fee a speed lock commission if you wish so you’re able to lock-on your own rate prior to the settlement day. It permits you to definitely protect the interest rates to own an excellent ages of ninety days. Certain charge a cost from the directory of $250 to $900 and others ount.

It’s worth pointing out one, generally, non-conforming otherwise pro lenders will charge large charges versus biggest loan providers.

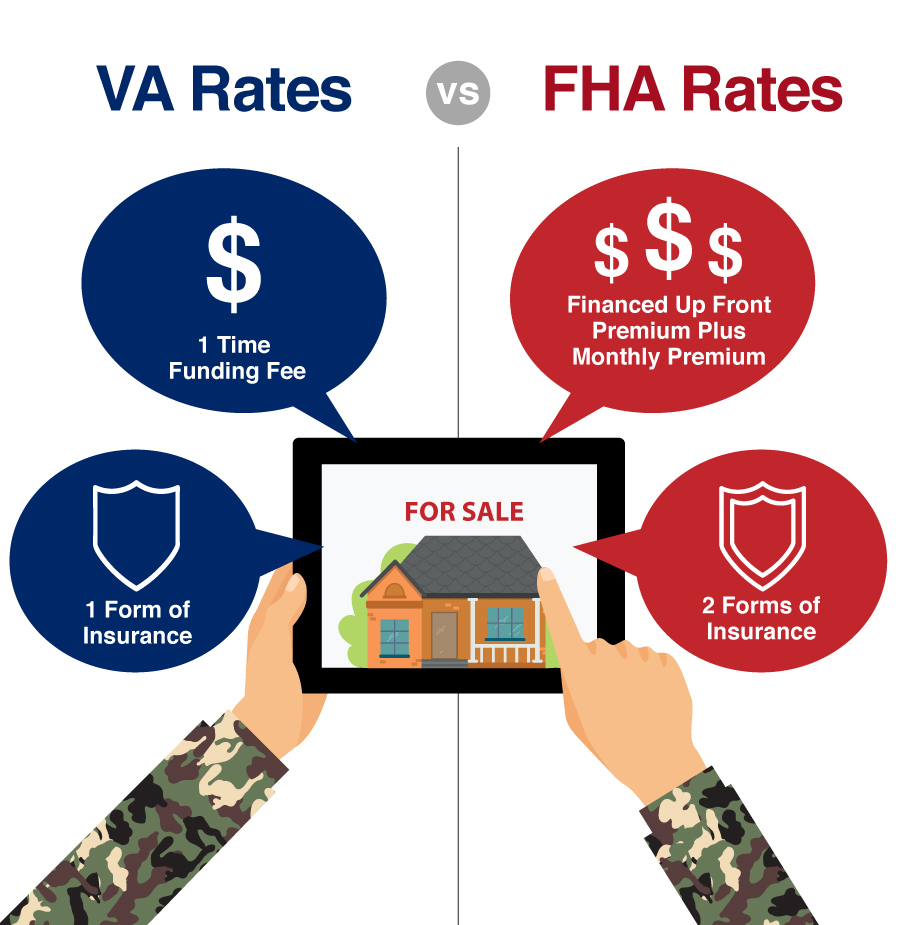

Loan providers Home loan Insurance rates

Lenders Home loan Insurance coverage (LMI) commission was a fee that’s appropriate once you borrow over 80% of the property well worth. Normally the largest pass product pricing when you take out a mortgage.

This new LMI fee becomes more pricey, more the loan to help you worth ratio (LVR) is. Like, individuals credit just 85% of the house value might get new LMI commission waived otherwise shell out a few thousand bucks, however, someone borrowing 95% of the property value is wanting on an LMI fee from tens and thousands of dollars. You can buy the newest LMI fee waived that have an effective guarantor domestic financing.

2. Charge which can apply within the identity of your own mortgage

- Lingering fees: There may be ongoing fees instance annual charge, month-to-month membership-keeping fees. It may be a great $15 monthly fee otherwise a yearly $395 fee. Whilst it might not look like much at first, considering you will have to spend $395 each year, they results in $eleven,850 over a 30-year financing identity. This money is most readily useful secured on your account.

- Later commission charges: Late fee charges are charges recharged after you skip the installment deadline because of the four working days. The newest charges are continually energized if you don’t pay back all arrears or enter a fees package along with your bank. The fresh new later payment charge is anywhere between $20 to $50 four weeks.

3. Charge to possess financial has actually

Lenders these days have become customisable, you could select the features you prefer. However, they are available having charge, so you should imagine even when they’re worth the fees.

- A lot more repayments: Additional costs are 100 % free. Using this type of ability, you have the capability to create additional payments into the mortgage in addition minimal loan fees. Purchasing actually a bit most when form you pay off of the financing far prior to and relieve the eye energized more the life span of your own mortgage. E.grams. When you yourself have good $eight hundred,000 mortgage within mortgage loan away from step 3% (29 season), while build most money from $200 month-to-month in the financing, you can pay the mortgage four years and you will 9 weeks earlier, and you will rescue doing $thirty-six,000 in the focus.