Hence, the total operating cost of Microsoft Inc. must be analysed over different quarters. This is to understand whether Microsoft Inc. is managing its operating costs effectively or not. In addition to this, investors can also access Microsoft’s operating expenses and Cost of Sales independently. This will help them to know if costs are increasing or decreasing over a period of time. The cash flow is affected immediately by any changes in operating costs.

Fixed Costs

Operating expenses are important because they help assess a company’s costs, reduce operating costs, and stock management efficiency. Essentially, they highlight the level of cost a company needs to make to generate revenue, which is ultimately the main goal of any business. When a business doesn’t successfully track its operating expenses, it can end up losing money on spending oversights.

Other Business Expenses

Outdated or inaccurate data can lead to flawed analyses and decision-making, potentially impacting the overall financial health of your project or business. Let us look at a few operating cost examples to understand the concept better. When analyzing operating cost ratios, it’s important to consider industry-specific factors and compare ratios to relevant benchmarks.

- Select the time frame for which you want to calculate operating costs (e.g., monthly, quarterly, annually).

- Strong revenue is always a good sign that the company is performing well.

- For example, a lemonade stand’s operating costs would include lemons, sugar, and water.

- Our website services, content, and products are for informational purposes only.

- Many people new to accounting concepts believe that operating costs and operating expenses are the same.

Managing Operating Expenses

So as a business owner, it is important for you to monitor the operating expenses of your business. Furthermore, fixed costs do not change over the life of a contract agreement or cost schedule. To calculate operating cost, you first need to determine the Cost of Goods Sold (COGS).

This is demonstrated in the cash flow statement, where the purchase of an asset falls under investing activities. In financial accounting, capital costs are not fully expensed during the purchasing year because their benefits extend over a long period. Instead, they are capitalized as an asset and then depreciated or amortized over their useful economic lives. This spreading out of costs allows a better match between expenditure and the income generated from these assets. It also reduces the tax liability in the first years of purchase as depreciation and amortization are tax-deductible.

Variable operating costs change proportionately with business activity; as output or sales increase, these costs rise and vice versa. Starting with revenues at the top, the income statement deducts operating costs to arrive at the operating profit. These costs, such as packaging materials, direct labor, utilities, shipping, and raw materials, fluctuate in sync with changes in production volume and sales. Understanding operating costs calculation is crucial for any business, as it provides a clear picture of the financial health and sustainability of a project. Operating expenses differ by industry and how a company decides to operate based on its business model. As a general rule, an increase in any type of operating costs lowers profit.

Can be short or long-term, depending on the nature of the expense or income. Recurring, directly linked to producing goods or providing services. These are long-term investments made in the business to acquire or maintain assets. ERP systems integrate various business functions, providing self-employment tax a centralized platform for real-time data access. For example, if you’ve invested $200,000 in plant and machinery, you’ll need to write off this capital expense over the useful life of the plant and machinery. Profitability is perhaps the most important financial calculation you can make.

Understanding your operating costs is crucial because they directly impact your bottom line. That’s why many business owners make reducing these expenses a top priority. Fixed costs can help in achieving economies of scale, as when many of a company’s costs are fixed, the company can make more profit per unit as it produces more units. Economies of scale can allow large companies to sell the same goods as smaller companies for lower prices. Rent, utilities, payroll, and insurance are common examples of operating costs. For example, a lemonade stand’s operating costs would include lemons, sugar, and water.

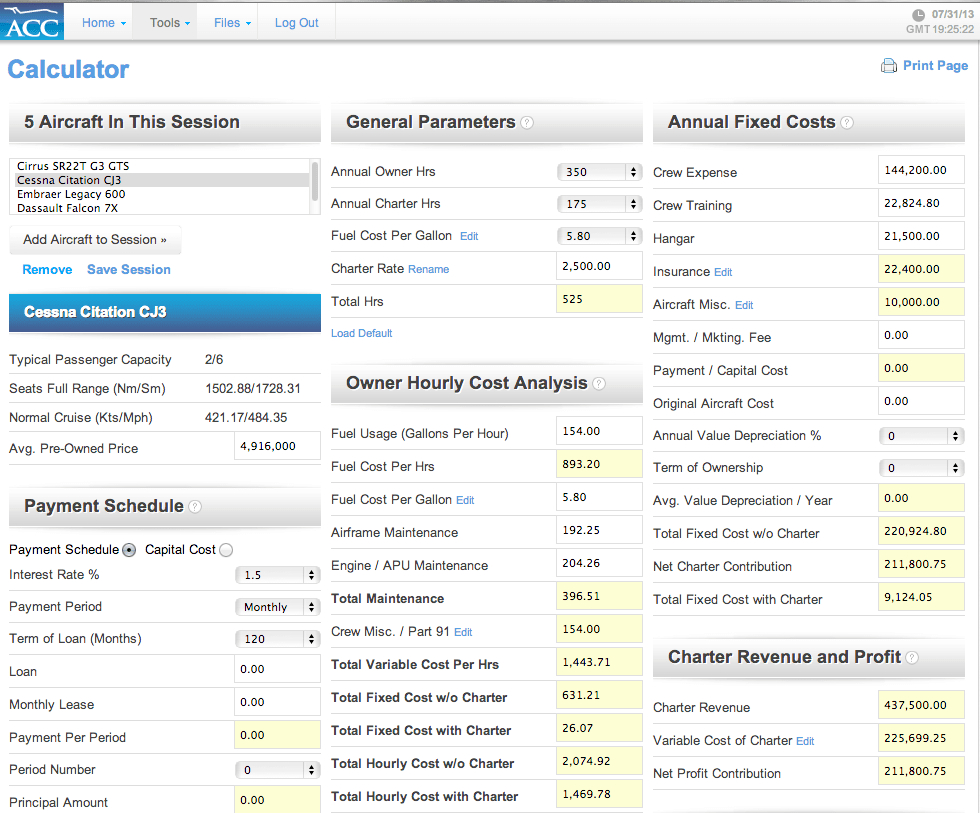

This business budget calculator is a tool for estimating the budget of your company. You can treat it as a business budget worksheet to plan out the upcoming months or quickly reassess your priorities. This calculator is pretty straightforward – you just have to input all values into appropriate boxes to obtain statistics that indicate how profitable your business is. Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.