Our team of reviewers are established professionals with decades of experience in preparing the statement: direct method areas of personal finance and hold many advanced degrees and certifications.

Freight Charges

The Purchases account is usually grouped with the income statement expense accounts in the chart of accounts. If a company uses the net method, but fails to remit the net amount within the discount period, the net method requires a debit entry to the expense Purchase Discounts Lost. In our example, if the company pays the invoice in 30 days, it is not entitled to the early payment discount and will therefore have to credit Cash for $1,000. The debit amounts include Accounts Payable for $980 and Purchase Discounts Lost for $20. Any amount recorded in Purchase Discounts Lost informs management that its policy of paying within the discount period has been violated. However, if the invoice is not paid within the discount period, an adjusting entry needs to be made under the net method in order to recognize the loss on the discount.

- Lastly, at the time of making payment (failing to get the advantage of cash discount), the journal entry to record the payment under both net and gross method are the same.

- This can result in a more complex reconciliation process and may require additional oversight to ensure that discounts are accurately captured and reported.

- Both methods provide the same result; however, the accounting journal entry is slightly different.

- The net method also encourages timely payments, as the financial records already assume that the discount will be taken, promoting a culture of financial discipline within the organization.

Journal Entries to Record Purchase Discounts Under Net Method

Businesses must first identify the discount terms, which are often stated as a percentage and a time frame, such as 2/10, n/30. This notation means a 2% discount is available if the invoice is paid within 10 days, with the net amount due in 30 days. By applying the discount percentage to the total invoice amount, companies can determine the net amount to be recorded. In our example, a 2% discount on a $10,000 invoice results in a $200 reduction, leading to a net recording of $9,800. This is because it records the effect of the discount at the time of purchase, rather than later when payment is made.

Why You Can Trust Finance Strategists

This allocation must also give consideration to any beginning inventory that was carried over from prior periods. While discounts may seem slight, they can represent substantial savings and should usually be taken. Consider the following calendar, assuming a purchase was made on May 31, terms 2/10, n/30.

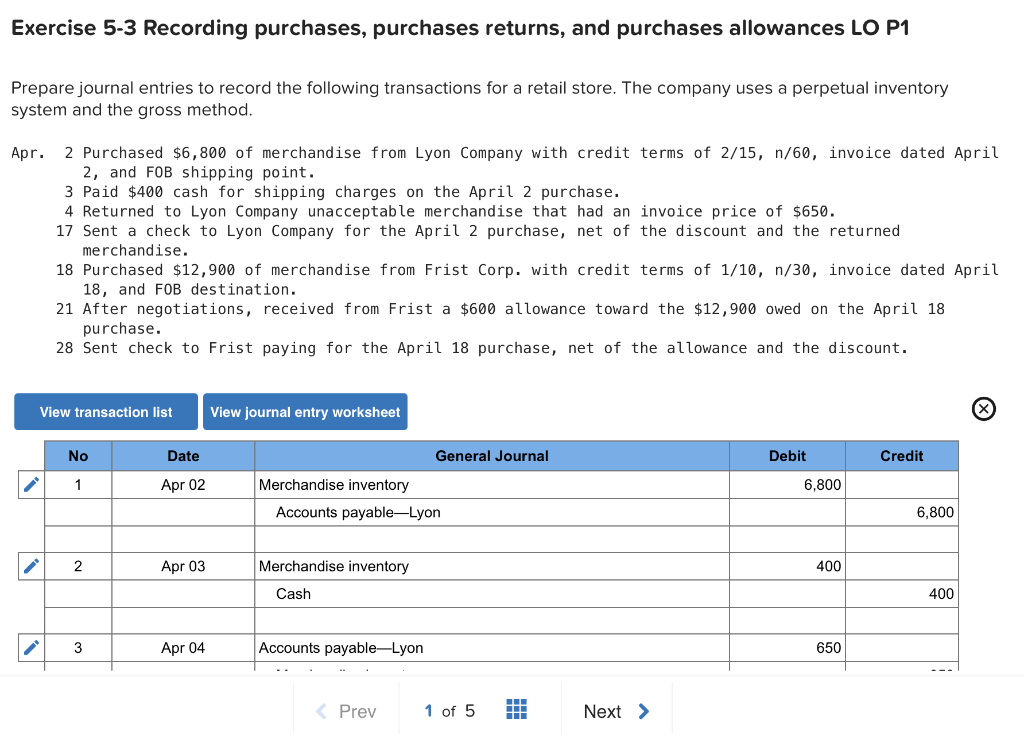

Journal entries in a perpetual inventory system:

This means that if there is an audit, it will be difficult to prove that the discounts have been properly accounted for and recorded. Additionally, it may result in overstating profits by not recognizing any purchase discounts at the time of payment. You may find your credit card service provider charges both a per-transaction fee you could record using the net method and a monthly fee you would record using the gross method. On 1st April 2013, Metro company purchases 15 washing machines at $500 per machine on account. The supplier allows a discount of 5% if payment is made within 10 days of purchase. This will particularly have impact when such sales transactions are recorded across financial statements.

Net Method of Recording Purchase Discounts

By focusing on net amounts, businesses can better anticipate their cash needs and plan accordingly. This is particularly beneficial for small and medium-sized enterprises that need to maintain tight control over their cash flow. The net method also encourages timely payments, as the financial records already assume that the discount will be taken, promoting a culture of financial discipline within the organization. The first phase of the merchandising cycle occurs when the merchant acquires goods to be stocked for resale to customers.

However, if payment is made after the discount period, the company would record the loss of the purchase discount as an expense or interest charge. In terms of cash flow management, the gross method may not provide the same level of foresight as the net method. Since discounts are not anticipated upfront, businesses may find it harder to predict their actual cash needs and availability. This can be particularly problematic for companies with tight cash flow constraints, as unexpected adjustments can disrupt financial planning and liquidity management.

The perpetual system is what we will be doing in the next unit as we study the perpetual system. Buyers must record shipping charges as transportation in (or freight in) when the goods were shipped FOB shipping point and they have received title to the merchandise. On the other hand, the gross method may initially inflate both revenues and expenses, leading to a higher reported taxable income until adjustments are made. This can result in temporary discrepancies in tax reporting, which may complicate tax planning and compliance. Businesses using the gross method must be diligent in tracking and reporting discounts separately to ensure that their tax filings accurately reflect their financial activities.

When recording a supplier invoice under the net method, the entry is a debit to the relevant expense or asset account, and a credit to the accounts payable account, using the net price. If the discount is not taken, this requires a later entry to charge the purchase discounts lost account (which is an expense account). O If goods are sold F.O.B. shipping point, freight prepaid, the seller prepays the trucking company as an accommodation to the purchaser. That is, the seller expects payment for the merchandise and a reimbursement for the freight.

The process of adjusting for uncollectible accounts involves estimating the amount of receivables that are unlikely to be collected and recording this estimate as an expense. Tools like aging schedules and historical data can help businesses make these estimates more accurately. By proactively managing uncollectible accounts, companies can maintain the integrity of their financial statements and ensure that their reported revenues and receivables are realistic. This practice is particularly important for businesses with a high volume of credit sales, where the risk of uncollectible accounts is more significant. The net method also has implications for financial ratios, which are critical tools for investors and analysts. Ratios such as the current ratio and quick ratio, which measure a company’s liquidity, can be more accurately assessed when liabilities are recorded at their net amounts.