Good HELOC can save you money by allowing you to borrow and you official site may shell out attention only towards amount you prefer. Into the a profit-away re-finance, you are able to shell out interest to the whole loan amount regarding big date one, no matter if it is more than your needed.

Minimal 640 credit rating applies to debt consolidating needs, lowest 670 pertains to cash out requests

A house security financing lets you borrow against the brand new equity within the your property with a fixed speed and you may repaired monthly payments. Learn how a property equity mortgage work.

Learning stuff is actually enjoyable, but getting the really very dining tables makes it easier and much more enjoyable. Hook samples of the very best.

Minimal 640 credit history pertains to debt consolidation reduction needs, lowest 670 relates to cash out desires

Property security financing allows you to borrow secured on the newest equity in the your residence having a fixed rates and you can repaired monthly payments. Learn how a property security mortgage functions.

Understanding content was enjoyable, but having the very extremely tables makes it much simpler and a lot more enjoyable. Connect types of some of the finest.

Reach ‘s the chief in electronic personal fund, designed to help people move ahead on the path to a much better financial coming.

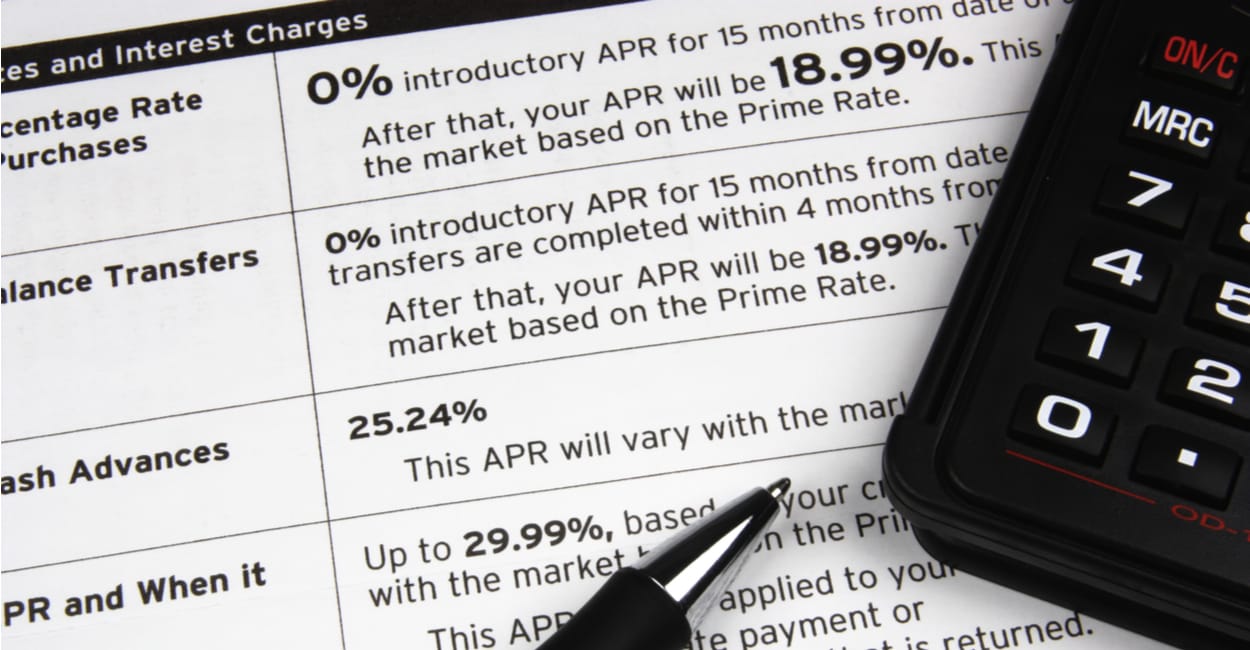

Signature loans appear as a consequence of all of our representative Achieve Unsecured loans (NMLS ID #227977), originated because of the Get across River Lender, a unique Jersey State Chartered Commercial Lender otherwise Pathward, Letter.An excellent., Equivalent Housing Lenders and might never be obtainable in all of the says. All financing and you will rate terms was susceptible to qualifications restrictions, software remark, credit score, loan amount, mortgage name, financial acceptance, credit need and you may history. Loans are not offered to owners of all says. Lowest mortgage wide variety are very different on account of state specific court constraints. Financing numbers generally include $5,000 so you can $fifty,000, will vary by condition and generally are considering according to meeting underwriting requirements and you may mortgage objective. APRs are priced between 8.99 so you can % and can include relevant origination charge you to definitely include 1.99% in order to 6.99%. The brand new origination fee was subtracted in the mortgage continues. Payment symptoms are priced between 24 to 60 days. Example mortgage: four-year $20,000 financing with an origination percentage from 6.99%, a speed out-of % and associated Annual percentage rate from %, will have a projected payment regarding $ and you will a complete cost of $26,. To qualify for an effective 8.99% Apr mortgage, a borrower will demand advanced level borrowing, a loan amount lower than $several,, and an expression off 24 months. Incorporating a beneficial co-borrower with plenty of income; playing with at the very least eighty-five % (85%) of one’s loan continues to pay off being qualified established financial obligation really; or indicating evidence of sufficient senior years deals, may help you together with qualify for all the way down rates. Financial support cycles is actually quotes and can are very different for each mortgage request. Same go out choices assume a done application with all required supporting files registered early sufficient on the day which our offices was open. Get to Personal loans instances are Saturday-Friday 6am-8pm MST, and you can Tuesday-Week-end 7am-4pm MST.

Domestic Equity funds arrive as a consequence of the associate Get to Money (NMLS ID #1810501), Equivalent Property Financial. Every financing and you can speed words try subject to eligibility constraints, app remark, credit score, amount borrowed, financing title, financial recognition, and credit incorporate and you can history. Mortgage brokers is actually a personal line of credit. Fund commonly available to customers of all the states and you may readily available financing terminology/costs ounts is actually ranging from 15,000 and you may $150,000 and generally are tasked considering loans in order to income and you may mortgage to help you value. Example: average HELOC try $57,150 that have an apr off % and you may projected payment per month out of $951 to have an effective fifteen-12 months mortgage. Almost every other conditions apply. Fixed rate APRs are priced between 8.75% – % consequently they are tasked predicated on credit history, combined financing so you’re able to really worth, lien standing and automated commission subscription (autopay subscription isnt a disorder away from loan acceptance). ten and 15 season terms readily available. Both terms and conditions has an effective 5 seasons draw period. Repayments was completely amortized while in the per several months and computed towards the outstanding dominant harmony each month. Closing fees are priced between $750 so you’re able to $6,685, according to range amount and county legislation standards and usually are origination (2.5% regarding range amount minus charge) and underwriting ($725) charges in the event that invited by-law. Assets should be owner-occupied and you can mutual mortgage to really worth might not go beyond 80%, like the the brand new financing demand. Assets insurance policy is necessary because the a condition of your financing and you will flood insurance may be needed if your topic home is discovered in the a ton region. You ought to pledge your property as guarantee and can even dump their family if you cannot pay-off. Contact Get to Money for further facts.

Pursuing the draw months, new repayment period begins. The monthly payment would be fixed on an expense that shell out off the mortgage towards the end of your repayment period.

Home collateral funds enables you to borrow on the security during the your home during the a reasonable speed

Cash-out re-finance mortgage loans typically have straight down rates of interest than simply HELOCs. Although not, for folks who curently have a decreased-interest on the current home loan, a profit-aside re-finance increases the price of paying down the bucks you still are obligated to pay.