Cutting-edge CRM Has actually To have A smooth Feel

- Tune and you can perform the lead processes.

- Look at money accrued.

- Song transformation, remark performance and you can engage people.

- Refer members to other borrowing products instantly.

- Advances buyers transformation, caring and you can retention having instant study retrieval and service enjoys.

- Full account.

- Complex statistics and expertise.

07.How do i effortlessly would and you can track the new status of one’s guides?

Anyone dreams of to acquire his personal household. A house may be the most costly investment one shopping within his or the woman entire lifestyle. The value of the home is approximately 5-8 times the brand new yearly earnings of individuals thus anyone you would like a financial solution to purchase a house.

That it loans service one banking institutions and loan providers provide is a great mortgage. Home financing generally loans your which have a lump sum equal to help you or less than the worth of your residence and so providing you will be making the purchase. It amount is repaid by anyone returning to financial institutions otherwise loan providers that have focus. . Find out more

Getting that loan away from a bank otherwise a lending institution try perhaps not a facile task. It will require a number of documentation, multiple pursue-ups and you may expertise in some possibilities. Home financing representative helps make this of getting a home financing simpler for you.

Who’s a home loan Representative?

A mortgage representative is actually a person who makes it possible to during the the procedure of getting a home loan straight from initiation with the final disbursement of money for you. All the bank and you can lender features subscribed individuals that function as financial agents. Certain financial agencies is freelancers and they are not of any loan providers.

A mortgage broker gets the necessary experience, knowledge and comprehension of various choices for delivering a home loan and will publication somebody otherwise people to choose a suitable family mortgage alternative that is suitable according to their financial situation and you may conditions.

Once you satisfy a home loan agent, they’re going using your borrowing from the bank profile, ensure you get your credit score report and then make extent of loan a man is qualified to receive as well as other possibilities you to definitely clients may take the home loan

Typically, financial agents came across customers directly and you will assisted you for the whole property loan processes. But not, has just, plenty mortgage broker come around any kind of time point in time in assisting clients due to their requests. For this reason, subscribers can use to possess home loans online as well towards the assistance of financial representatives

Who will be a home loan broker?

Into the Asia, one Indian resident above the age of 18 which have at least certification from 12th degree is approved becoming home financing broker.

Aside from the lowest education degree, its expected you to mortgage agents are great within interaction and you may networking experience.

The capability to familiarize yourself with selection, sympathize having members and you may persuasion are also the fresh characteristics out-of a good mortgage broker. Become a mortgage broker is additionally a part-community of many individuals that means no investments as such.

Benefits associated with To get Homes Financing Agent which have Choices Hook

An individual looking to getting a mortgage representative demands this new correct platform in order to discover the many areas of house fund and you can arrived at to get in touch having customers regarding certain edges out of the world

Options connect was a diverse financial conglomerate one to empowers visitors to feel home loan agents taught by top financial institutions. Here are some of the experts one to installment loans for bad credit in New Castle Choice Connect provides to the fresh new dining table:

Write a new income source for lifetime- Accompanying which have Options Link makes it possible to feel a home loan broker that may serve you having a passive source of income to have a lifetime.

Independency Brand new paperless and advanced software from the Choices Hook helps you which have the flexibleness to make work from anywhere and you will whenever centered on the convenience.

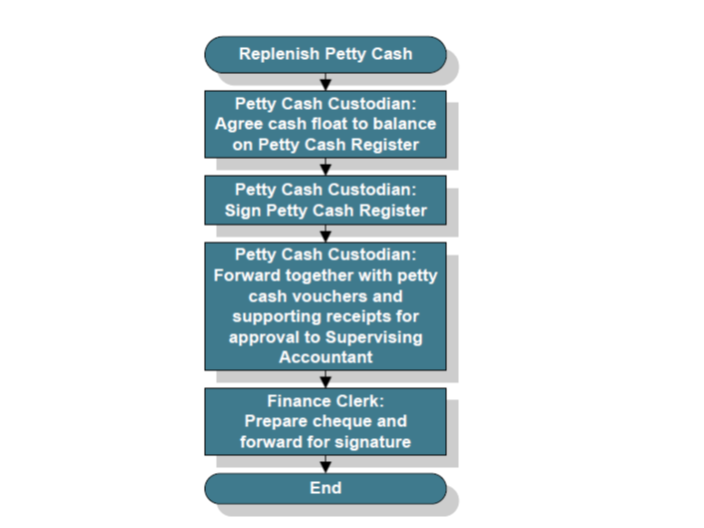

Accessibility advanced CRM Solutions Hook possess purchased a high-quality CRM that can help home loan agents’ track all of their prospects towards the a bona fide-big date foundation to help representatives into workflows of every and you may every visitors on a follow this link off a pc key.

Clear no Deposit Several establishments request dumps to be financial agencies. Alternatives Hook is just one of the few top brands throughout the sector that will help you become a home loan agent without any profits and assists your are employed in a totally clear fashion.

How to become Home loan Broker

Some other systems has actually various other procedures to register due to the fact a mortgage representative. As home financing representative toward Options Connect Program try very easy and the method constitutes cuatro strategies:

Due to the fact mobile phone and you may email was confirmed, you will want to go into your own first pointers as well as your target. In this action, you also need to help you enter in your Permanent Membership Level of Bowl.

Post giving the basic information, you need to incorporate your identity research and you will publish a smooth copy of your own term facts.

Once your files is actually submitted and you will affirmed from the Choices Connect, you are all set and you will get on the system and start getting guidelines.