The contribution margin is the amount of revenue in excess of variable costs. One way to express it is on a per-unit basis, such as standard price (SP) per unit less variable cost per unit. Alternatively, companies that rely on shipping and delivery companies that use driverless technology may be faced with an increase in transportation category:computer file systems wikipedia or shipping costs (variable costs). These costs may be higher because technology is often more expensive when it is new than it will be in the future, when it is easier and more cost effective to produce and also more accessible. The same will likely happen over time with the cost of creating and using driverless transportation.

Step 3 of 3

In the Dobson Books Company example, the total variable costs of selling $200,000 worth of books were $80,000. Remember, the per-unit variable cost of producing a single unit of your product in a particular production schedule remains constant. The contribution margin further tells you how to separate total fixed cost and profit elements or components from product sales. On top of that, contribution margins help you determine the selling price range for a product or the possible prices at which you can sell that product wisely. A higher contribution margin is usually better, and more money is available for fixed expenses.

Operating Profit or Loss

Fixed costs are used in the break even analysis to determine the price and the level of production. Contribution Margin refers to the amount of money remaining to cover the fixed cost of your business. That is, it refers to the additional money that your business generates after deducting the variable costs of manufacturing your products. To run a company successfully, you need to know everything about your business, including its financials.

Contribution Margin Ratio FAQs

- To calculate this figure, you start by looking at a traditional income statement and recategorizing all costs as fixed or variable.

- In particular, the use-case of the contribution margin is most practical for companies in setting prices on their products and services appropriately to optimize their revenue growth and profitability potential.

- Variable expenses can be compared year over year to establish a trend and show how profits are affected.

- Fixed costs are often considered sunk costs that once spent cannot be recovered.

- Gross profit margin includes all the costs you incur to make a sale, including both the variable costs and the fixed costs, like the cost of machinery or equipment.

Very low or negative contribution margin values indicate economically nonviable products whose manufacturing and sales eat up a large portion of the revenues. Alternatively, the company can also try finding ways to improve revenues. For example, they can simply increase the price of their products. However, this strategy could ultimately backfire, and hurt profits if customers are unwilling to pay the higher price.

How is contribution margin calculated?

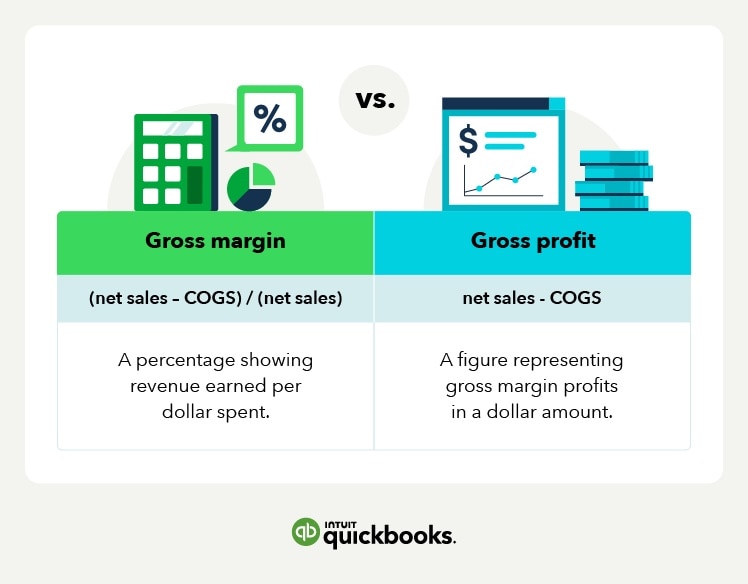

When she’s not writing, Barbara likes to research public companies and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg. The contribution margin is of great importance to companies for several reasons, which are outlined below. These terms and explanations provide a comprehensive overview of the main concepts related to the contribution margin and their business relevance. These can fluctuate from time to time, such as the cost of electricity or certain supplies that depend on supply chain status. One common misconception pertains to the difference between the CM and the gross margin (GM). A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Great! The Financial Professional Will Get Back To You Soon.

Selling price per unit times number of units sold for Product A equals total product revenue. At the product level In a manufacturing company, variable costs change, depending on the volume of production. As more units are produced, total variable costs for the product increase.

As we said earlier, variable costs have a direct relationship with production levels. As production levels increase, so do variable costs and vise versa. Variable costs are not typically reported on general purpose financial statements as a separate category. Thus, you will need to scan the income statement for variable costs and tally the list.

As mentioned earlier, the contribution margin ratio can help businesses determine the lowest possible price at which sales can be made and still break even. This analysis can aid in setting prices, planning sales or discounts, and managing additional costs like delivery fees. For example, a company aspiring to offer free delivery should achieve a scale where such an offering doesn’t negatively impact profits. The first step to calculate the contribution margin is to determine the net sales of your business.

Such an analysis would help you to undertake better decisions regarding where and how to sell your products. Fixed costs usually stay the same no matter how many units you create or sell. The fixed costs for a contribution margin equation become a smaller percentage of each unit’s cost as you make or sell more of those units. Consider its name — the contribution margin is how much the sale of a particular product or service contributes to your company’s overall profitability. It’s how valuable the sale of a specific product or product line is. Company XYZ receives $10,000 in revenue for each widget it produces, while variable costs for the widget are $6,000.

The following diagram shows an overview of some important reasons for the contribution margin. Evangelina Petrakis, 21, was in high school when she posted on social media for fun — then realized a business opportunity. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. As of Year 0, the first year of our projections, our hypothetical company has the following financials. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.