The new meteoric growth of Rocket Financial enjoys demonstrated just what loan officials need to do to keep to-be competitive from the industries out of tomorrow. The answer? Embrace a hybrid mortgage credit techniques.

A crossbreed financial approach brings together the standard, relationship-heavy, financing processes with today’s technology aimed at enhancing and you may streamlining new processes. Lower than, we shall direct you how-to do so.

These people were what regarding Quicken Loans’ captain economist, Bob Walters. Whether or not Quicken Loans / Rocket Home loan started $79 mil within the 2015 home loan frequency, we feel the role of the loan administrator isn’t dying, nonetheless it certainly must progress.

The fresh new mark to Rocket Mortgage: financial automation

Understand between the lines and is easy to see just what Most drives the financial credit prowess: automation and overall performance.

The results are impossible to skip. Nonbank loan providers, such as for instance Quicken Loans, have experienced the display of your domestic mortgage , such nonbank loan providers started 23% of domestic home loan one count had grown in order to 43%.

They will have establish a network that makes it simple for a potential borrower to submit the fresh documents had a need to rating a keen underwriting decision. Earnings, assets, bills, fico scores, and the like try immediately removed into program when you’re state-of-the-art algorithms performs behind the scenes to build a set of financing solutions.

Automatic file and you may resource recovery by yourself is a significant mark (read: time-saver) getting borrowers, nevertheless they also add on the particular nice features such as for instance eSignature and you will personalized pre-approval emails to have consumers.

Difficulties with Skyrocket Mortgage: insufficient provider and you can mortgage assistance

Think this circumstance: you’re going to get willing to pick a home, you will be making the Quicken Fund membership, go into your own personal suggestions and you can remove your income and you can assets towards the program and you can voila you have got certain loan information.

Now the enjoyment begins! With Skyrocket Home loan, the customer is personalize its loan alternatives because of the changing slider pubs to possess such things as closing costs, loan terms and conditions and you will interest levels.

This is so that fascinating! We have got my personal finest loan setup, now let me strike the See if I am Accepted button aaaaaaaannnnd: Refused.

Truly the only option at this point is so you can simply click an alternate switch to speak with a call-cardiovascular system mortgage broker whom, with no knowledge of something towards borrower, will try to find out how it happened. Plenty to have punctual and you may successful.

For someone to make what is actually potentially the greatest purchase of its existence, this is just maybe not appropriate https://paydayloanalabama.com/brantley/. The difficulties occurring here are just what prompt the need for a beneficial hybrid home loan techniques.

This call centre and is wanting to fill new role that the mortgage administrator enjoys from inside the a classic setting: pointers and you can advice in an elaborate and you can mental purchase, responses when you need them, experience in the brand new underwriting conditions necessary to get your mortgage recognized, in addition to pursue-by way of needed seriously to get you to closing.

The loan manager is also a member of the neighborhood. They are able to build recommendations on regional Real estate agents, when to re-finance, otherwise assist you with a house collateral otherwise HELOC (affairs Quicken/Rocket will not promote) when the day is right.

Adding technical to your a hybrid financial procedure

The main is to study from this new sessions educated by borrowers through the usage of Skyrocket Financial: consumers need a simplistic and sleek procedure, that have simpler accessibility recommendations, and you can modern technology on its fingertips.

Speaking of features you to that loan administrator Can provide, to the best possibilities positioned, while also incorporating enormous well worth out of a 1:step 1 connection with individuals.

The purpose-of-income

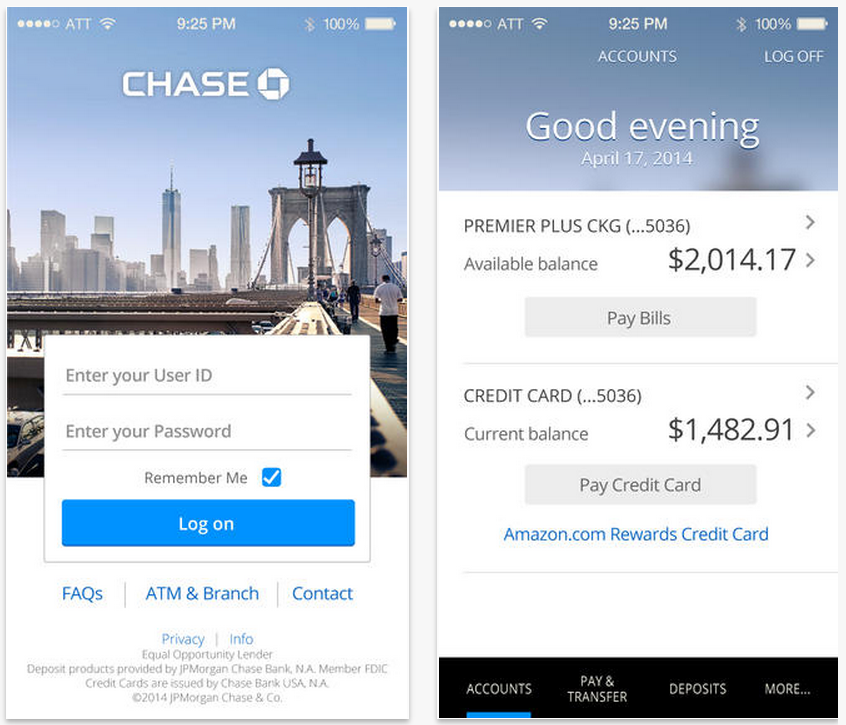

The brand new POS is a fantastic example of the pros a beneficial LO is reap from the adding complex tech to their origination procedure. The current home loan part-of-income gets the technical efficiencies and you may mobile-friendly sense you to definitely consumers attract:

- User-friendly and safe portal so you’re able to streamline document range.

- Included functions to have ordering head-resource borrowing from the bank, assets/places, employment, and you will money verifications.

- Automatic financing standing reputation to save consumers advised throughout the entire procedure.

- eSignature.

- Led, interview-concept application for the loan.

- Mobile app w/ images upload potential.

Not just do brand new POS system do-all on the for the latest borrower, but the concrete benefit to the mortgage maker allows them to score that loan document into the underwriting reduced, with a high amount of precision. This conspires to one another to aid rating fund funded smaller and you can smoother than simply via heritage processes.

This is certainly all of the borrowers are extremely requesting, and why they usually have considered the brand new Quicken Loans’ / Skyrocket Mortgages around the globe. The fresh emphasis is placed towards the show and you may openness.

The conclusion

You dont want to be Rocket Mortgage. The reason for Rocket Home loan will be to basically take away the mortgage administrator on the home loan origination procedure. However, it is impossible to ignore the development of nonbank lenders such as for example Quicken Money. One development increase has actually presented the brand new guidance an individual are requiring your globe disperse: send.

On advent of the new innovation and applications eg Fannie Mae’s Day step 1 Certainty, it’s certain that the features read the latest warning bells noisy and clear. You should progress, or you will end up being passed by the group.