Losing your residence? Name Arizona New Start!

Shedding trailing on the mortgage payments can also be put you plus family members lower than loads of worry. From the Arizona New Initiate, we have been here so you can prevent foreclosures on the house or to avoid people foreclosure steps which have currently started. This might be completed due to negotiation or by the filing bankruptcy, both of which can avoid foreclosure procedures in your home.

Foreclosure Evaluation

A property foreclosure is what occurs when the mortgager struggles to continue the promise with the bank or bank who’s an excellent lien on their where you can find spend its mortgage repayments timely. The lender after that requires lawsuit to get control of your assets, to try to offer the property as an easy way out of satisfying your debt. When this process is complete the fresh new citizen manages to lose every legal rights so you’re able to the property and, if required, might be evicted. Which sad a number of occurrences will be eliminated towards the correct preventive steps. Will a loan provider initiates regulations suit defectively which can score the newest property foreclosure disregarded having a genuine shelter. Usually the amazing home loan company offered your debt therefore, the amazing needed paperwork can not be acquired as there are zero directly to foreclose. Lenders you should never compensate charges just because you are in property foreclosure therefore you are entitled to rebel. Loan providers need certainly to follow individual shelter rules. In case the mortgage is regarded as an excellent predatory loan, that is a security. Whenever you are given a loan amendment and then its later on refuted, that can serve as a cover.

One way to stop foreclosure is always to discuss with your lender, sometimes to modify your mortgage or perhaps to settle the debt. Mortgage improvement lower the interest rates or concept for the financing or offer the title therefore, the monthly payments is actually reduced. As for credit card debt relief, this occurs when your lender welcomes a lump sum one to try less than the total amount due, but considers that it is complete payment. You might also think debt consolidation, and this brings together several individual expense to the that financing which means that your excessively interest rates was removed, reducing the matter you only pay per month. The greatest goal should be to help make your money sensible so that you might get caught up.

Personal bankruptcy & Foreclosure Safety

When you simply can’t customize your loan or manage repayments, you could seek bankruptcy relief. Once you retain a bankruptcy proceeding attorney or document lower than Part 7 or Section thirteen, an automatic remain is placed with the one foreclosure measures. You might be able to save your house if is actually exempt regarding liquidation, or if you have the ability to reorganize the debt compliment of case of bankruptcy. Most other popular foreclosure defenses through the after the:

Home loan servicers (agencies exactly who deal that have finance companies and other lenders to receive and disburse mortgage repayments and you can demand the regards to the mortgage) make mistakes all round the day when they are making reference to individuals.

- crediting your payments for the completely wrong people (so that you were not, in fact, delinquent towards the amount asserted of the foreclosing party)

- imposing an excessive amount of charges or costs not authorized of the lender or holder, or

- dramatically overstating extent you must shell out so you’re able to reinstate your own financial.

Errors into count you should spend in order to reinstate their home loan are especially significant. For the reason that an overstated matter get deprive your of your own head solution accessible to keep home. For example, in case your mortgage-holder states you borrowed $4,500 so you can reinstate (possibly because it imposes unreasonable costs and you may fees), when in fact you borrowed from only $step 3,000, you may not were in a position to benefit from reinstatement (state you could have provided $3,000, although not $4,500).

You’re in a position to endeavor their property foreclosure from the exhibiting that your financial violated a national or county legislation made to manage borrowers away from illegal financing means. Two government laws and regulations avoid unjust financing methods of this domestic mortgage loans and you can finance: the fact in Financing Operate (TILA) and a modification to help you TILA aren’t called our home Control and Equity Safeguards Act (HOEPA).

Loan providers violate TILA once they never make certain disclosures regarding home loan data, for instance the apr, this new money costs, extent funded, the complete money, this new fee schedule, and.

In the example of fund covered by HOEPA, loan providers need certainly to conform to some see provisions and so are prohibited out of playing with specific financial terminology, including prepayment penalties when your financing is actually a leading-pricing mortgage.

Contact a foreclosure safeguards attorneys within the Tacoma, WA

Take a moment to engage in a free of charge instance testing that have Tacoma Bankruptcy Lawyer David Yando if you would like defend the household out-of property foreclosure. Along with three decades of debt relief and you may bankruptcy feel, Mr. Yando is more than able to guidance you through the bankruptcy procedure or any alternative so you’re able to bankruptcy. E mail us immediately to learn more.

“I really must many thanks for your hard performs, day, and you may work off my personal Personal bankruptcy Circumstances! Youre the BK Lawyer plus feel demonstrably reveals. Specifically, in how thorough, sincere and up front side you are away from go out you to definitely…and you may proceeded regarding entire process. I must say i delight in their the means to access…of responding and/otherwise returning my phone calls on time, to purchasing face-some time sitting down to discuss things in your place of work.”

Washington New Begin

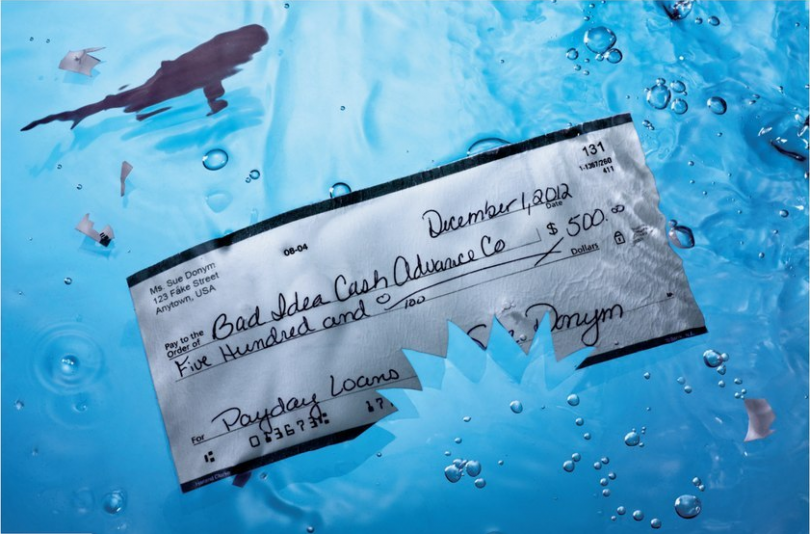

We have been a debt relief agency. We help some body file for bankruptcy rescue according to the Bankruptcy Code. All the details on the site when the to own general information objectives simply. Absolutely nothing on this site can be removed because the legal counsel to have people circumstances or state. This information is maybe not intended to perform, and you can receipt otherwise seeing doesn’t make up, a lawyer-customer payday loans El Jebel dating.