In addition, continuous inventory taking is made possible because the systems maintain a running account that is updated with each sale or return. A firm may occasionally encounter product recalls, purchases return, and misplaced products in transit. However, there is no way to consider these unforeseen changes with the periodic inventory.

Characteristics of the Perpetual and Periodic Inventory Systems

When you buy anything in a physical shop or online, the merchant has complete knowledge of what was purchased and when allowing them to plan for restocking. A sales allowance and sales discount follow the same recording formats for either perpetual or periodic inventory systems. irs overhauls form w A perpetual inventory system automatically updates and records the inventory account every time a sale, or purchase of inventory, occurs. You can consider this “recording as you go.” The recognition of each sale or purchase happens immediately upon sale or purchase.

Great! The Financial Professional Will Get Back To You Soon.

- Organisations use estimates for mid-year markers, such as monthly and quarterly reports.

- The transaction will record inventory based on the month-end physical count.

- This helps in ensuring that the stock levels are accurate and that any discrepancies can be rectified.

- However, the sheer volume of transactions in some merchandising businesses makes it impossible to use anything but the periodic system.

- Setting up a periodic inventory system is an essential part of maintaining accurate stock records.

Therefore, up to the conclusion of the next term, inventory records remain fixed. To ensure they never run out of supply, sophisticated firms may set up automatic reordering. The continuing data assists firms in maintaining more detailed data on cost per item sold, which plays a significant role in profit margins and overall profitability. Operating using a periodic inventory method is like running your firm while wearing blinders for huge businesses or developing enterprises. A perpetual inventory system is a software system that continuously collects data about a company’s products. A perpetual system tracks every transaction as it happens, including purchases and sales.

Shipping on Inventory Purchases

The GAAP is the set of accounting principles, standards, and procedures issued by the Financial Accounting Standards Board (FASB) to guide virtually every accounting scenario. As stock levels arise, and your company grows, the periodic inventory system becomes complex and difficult to manage. That’s why the approach isn’t suitable for every type of company, and the majority of businesses use perpetual inventory instead.

Perpetual Inventory System

The periodic inventory system is a software system that supports taking a periodic count of stock. Companies import stock numbers into the software, perform an initial physical review of goods and then import the data into the software to reconcile. The guide has everything you need to understand and use a periodic inventory system. You’ll find basic journal entries, formulas, sample problems, guidance, expert advice and helpful visuals.

Create a Free Account and Ask Any Financial Question

The commencement of the subsequent accounting period subsequently starts with the data for the ending inventory. Businesses that use periodic inventory systems update their general ledger accounts for the ending inventory after each physical count. Physical inspections of the inventory are done using the periodic inventory control system. Since most of these jobs are done by hand, the process takes time and is expensive. As a result, businesses with significant inventories must allocate personnel and time each time a physical inventory count is conducted.

Let’s say you are running a retail business, in which your firm must purchase inventory almost every day to run your day-to-day business. Of course, some of that inventory can become” Finished Goods” and be sold during the period, but your accountant doesn’t need to worry about that. Instead, a “purchase account” will be created in a periodic system for each bought inventory, which is an ‘asset.’ All the inventory purchases are stored in this account.

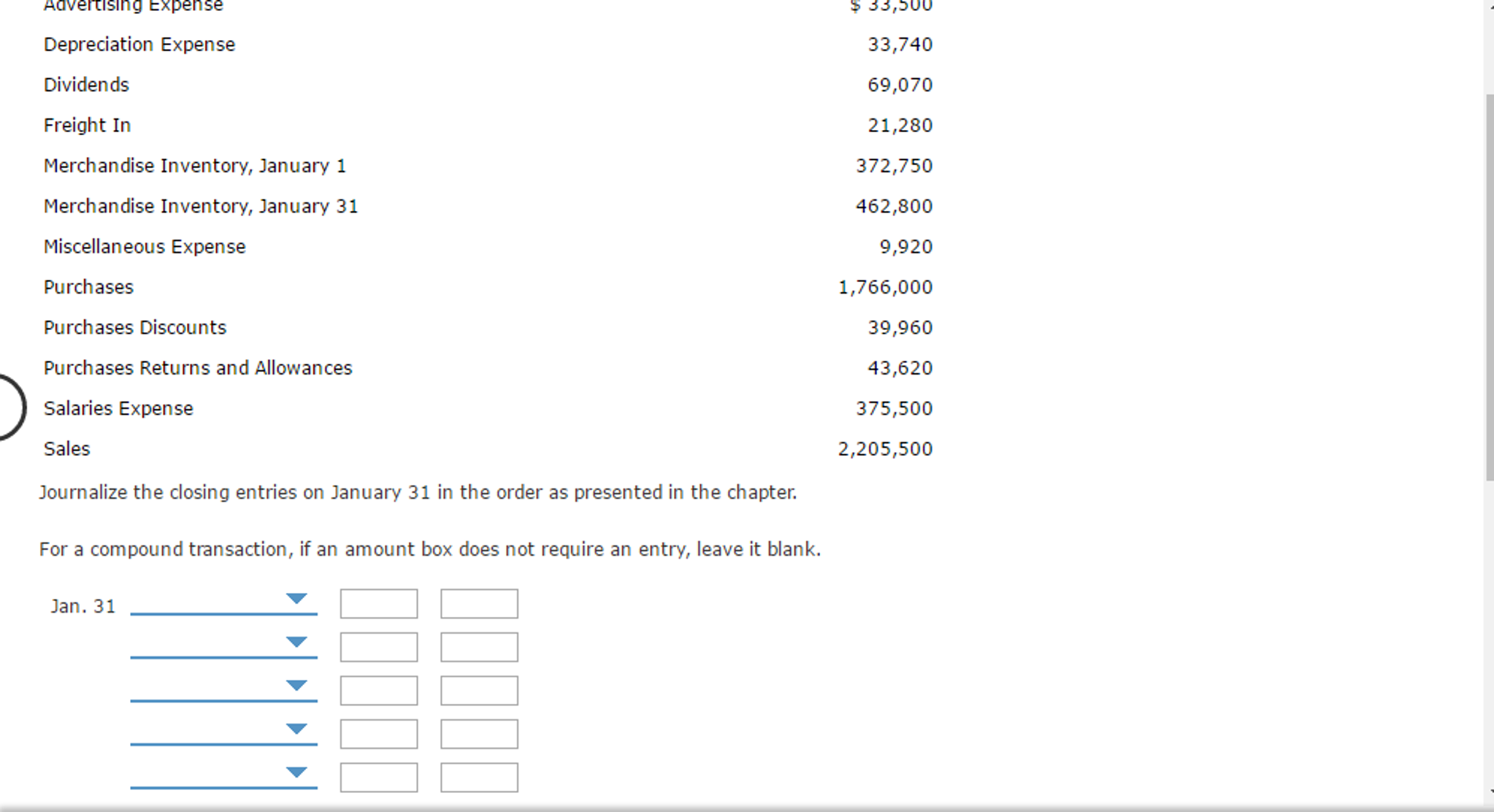

The time commitment to train and retrain staff to update inventory is considerable. In addition, since there are fewer physical counts of inventory, the figures recorded in the system may be drastically different from inventory levels in the actual warehouse. A company may not have correct inventory stock and could make financial decisions based on incorrect data. Under periodic inventory procedure, the Merchandise Inventory account is updated periodically after a physical count has been made.

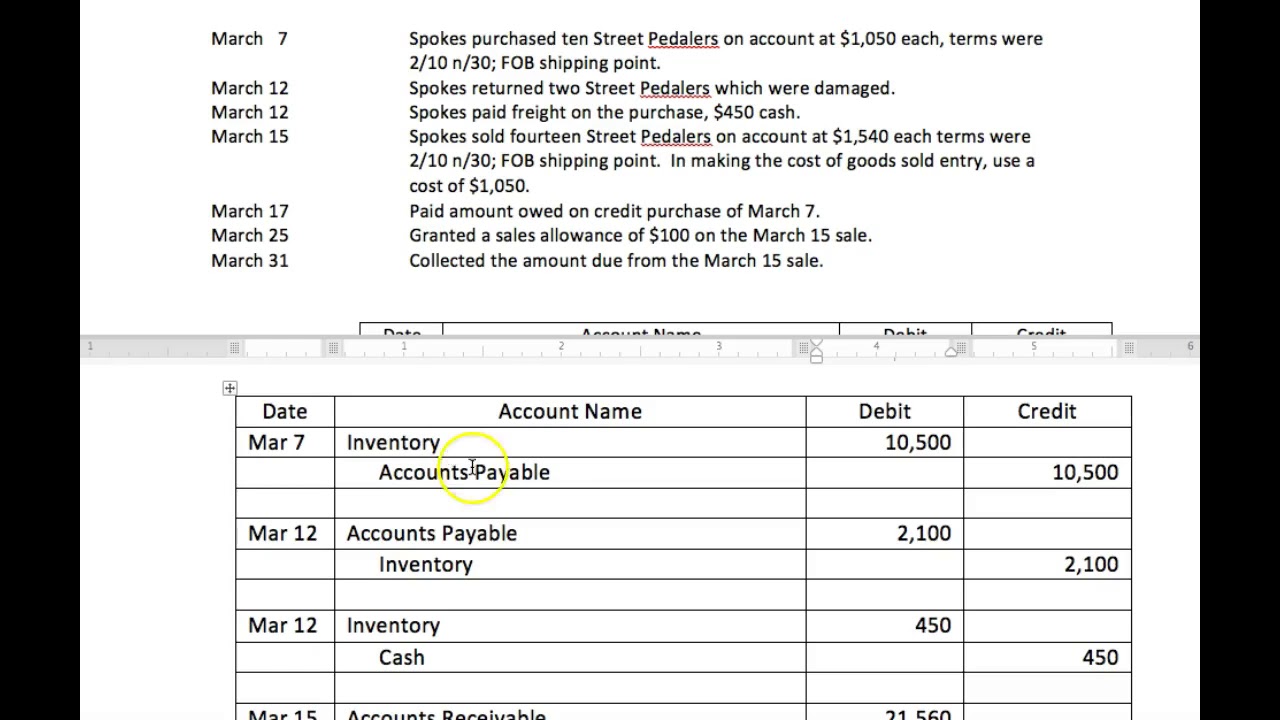

Financial and Managerial Accounting Copyright © 2021 by Lolita Paff is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. Once the COGS balance has been established, an adjustment is made to Merchandise Inventory and COGS, and COGS is closed to prepare for the next period. Build a growing, resilient business by clearing the unique hurdles that small companies face. Buyers must record shipping charges as transportation in (or Freight In) when the goods were shipped FOB shipping point and they have received title to the merchandise. Get Accounting, CRM & Payroll in one integrated package with Deskera All-in-One.

The net sale will be recorded only $ 9,500 due to the discount while the accounts receivable increase only $ 9,500 too. Because these costs result from the acquisition of an asset that eventually becomes an expense when sold, they follow the same debit and credit rules as those accounts. The periodic Inventory System method might not be suited for large enterprises due to the high amount of inventory transactions. This is because large organisations must continually track the number of items in their inventory to make essential purchase choices.