To invest in a home can seem to be such as an intricate processes, however with FHA Loans, there was a very clear roadmap to adhere to. Here is a basic review of the entire tips on it:

- Get Pre-accredited : Before you start home browse, delivering pre-certified is extremely important , because this offers a very clear picture of the borrowing from the bank fuel and just how much you might comfortably pay for. Good pre-degree from an established lender like DSLD Financial is actually a powerful sign to vendors your a critical client.

- Come across Your perfect Household : Together with your pre-certification at hand, you could confidently discuss the business to suit your prime domestic. Think about, new FHA Mortgage provides particular possessions appraisal conditions , making it important to factor that into the during your research.

- Collect The loan App : After you’ve found your dream home, it’s time to collect the loan application bundle . This may typically were money verification documents, lender comments, taxation statements, and you can proof of homeowner’s insurance. An effective DSLD Mortgage loan Administrator can also be make suggestions from this process and make certain you really have everything you required for a flaccid app.

- Underwriting and you can Recognition : The financial institution usually carefully feedback your application and help documents so you’re able to determine the qualifications into the FHA Loan. This phase you are going to include straight back-and-ahead communication to be certain all of the vital information emerges.

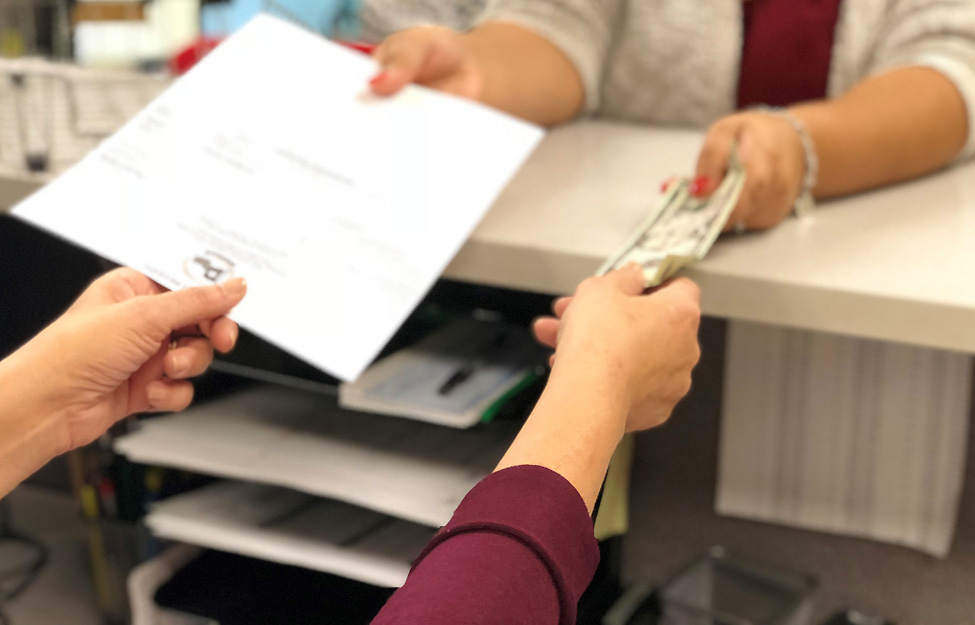

- Closure : When your mortgage is eligible, it’s the perfect time into domestic closure processes . That’s where you’ll be able to submit the newest documents and you will commercially become a homeowner. Be prepared to bring your settlement costs , that will include various charge of this financing and you can house pick.

Information these types of strategies will help you approach the newest FHA Financing processes with certainty. Contemplate, DSLD Home loan will be here to support your every step of one’s means.

FHA Financing Faqs: Your questions Responded

At DSLD Financial, we realize one FHA Fund can spark plenty of issues. So you’re able to on your homeownership trip, we collected answers to specific faq’s:

Is actually an FHA Financing suitable for me?

FHA Fund are a good option for basic-day homeowners , people with modest credit scores, or those who may not have a giant down-payment saved. not, it is far from a single-size-fits-all solution. Believe consulting with a mortgage top-notch to talk about your specific state and determine in the event that an enthusiastic FHA Loan aligns together with your monetary wants.

Exactly what credit history manage I would like to own an enthusiastic FHA Mortgage?

Minimal credit rating significance of an enthusiastic FHA Loan that have an excellent step three.5% advance payment usually drops from the middle-600s. However, a high credit history can also be be considered your to own most readily useful financing terms and conditions, such as a diminished interest rate.

The good thing about FHA Fund is the low down percentage requirement. You could end up being a citizen which have the absolute minimum down-payment off merely 3.5% of your price.

Were there different varieties of FHA Financing?

speedycashloan.net bad credit loans online

Yes! The best FHA Mortgage ‘s the 203(b) system for purchasing just one-house. Yet not, there are also alternatives for recovery loans (203(k)) and you may refinancing current mortgages.

Exactly what are the closing costs on the an enthusiastic FHA Loan?

Closing costs generally become origination charges, assessment fees, label research charge, and various other charges. A great DSLD Real estate loan Manager also provide a very particular guess predicated on your position.

Own Your ideal House with an enthusiastic FHA Mortgage

Maybe you’ve imagined owning a home but experienced frustrated because of the concept of a high advance payment or a quicker-than-primary credit rating? An enthusiastic FHA Loan could be the the answer to unlocking the entranceway to the dream house!

Because the we’ve searched, FHA Fund give an approach to homeownership which have a decreased down percentage out of just step three.5%, far more versatile credit score standards, and you can many financing options to suit your needs. Regardless if you are a first-date homebuyer otherwise seeking a more affordable investment alternative, FHA Loans can be a-game-changer.