show which:

Unlocking the potential of the house’s collateral using a home Guarantee Personal line of credit (HELOC) offer homeowners which have economic self-reliance. A great HELOC differs from a classic household collateral financing by providing an excellent rotating personal line of credit, enabling you to borrow cash as needed around the recognized restriction. Knowing the HELOC app processes, plus qualifications conditions as well as the mark and you will installment attacks, is essential for making told monetary behavior.

Qualifying getting a HELOC: Secret Criteria

To get recognition having a great HELOC, loan providers generally speaking envision multiple affairs, including how much cash collateral you really have of your property, your credit score, along with your obligations-to-earnings proportion.

Sufficient Home Guarantee

So you can qualify for a beneficial HELOC, people need to have enough collateral within property. Collateral ‘s the difference between their home’s current market value and your a good mortgage equilibrium. Such as for instance, when your house is appreciated at $300,000 and you have a mortgage equilibrium out-of $150,000, your house guarantee are $150,000. Loan providers usually want borrowers for no less than 1520% equity before giving a good HELOC app. It indicates your home loan equilibrium are going to be 8085% or less of your own home’s really worth.

Reliable Earnings

Lenders wanted proof consistent earnings to be certain you could manage the additional monthly obligations of an effective HELOC. So you’re able to be considered, you might have to give documents instance:

- Work money. W-dos mode, financial statements, and you may latest pay stubs

- Self-work income. Tax returns and you may funds losings comments

- Old age earnings. Public Shelter statements, retirement, or annuity suggestions

- Most other earnings present. Files for even more earnings, for example rental property money or financing productivity

Strong Creditworthiness

A strong credit history and responsible credit management are essential to own HELOC recognition. Lenders very carefully evaluate your own creditworthiness to determine the loan eligibility. A credit score usually significantly more than 680, along with a consistent reputation of for the-day money, shows debt reliability. Building and you will keeping an effective borrowing from the bank character can help you safe beneficial HELOC words.

Reasonable Obligations-to-Earnings Proportion

Your debt-to-income (DTI) ratio actions your month-to-month financial obligation payments (credit cards, automotive loans, etc.) prior to your earnings. Loan providers play with DTI to assess what you can do to cope with extra monetary personal debt. A reduced DTI, generally speaking less than 43%, essentially advances your chances of HELOC recognition. To switch their DTI, imagine paying off present loans, expanding money, or refinancing high-notice finance.

Wisdom HELOC Mark and Installment Attacks

A HELOC operates in 2 stages: the newest draw months as well as the fees several months. Within the mark period, typically long-term any where from 5 in order to 10 years, you have access to financing as required, up to their credit limit. You’re fundamentally obligated to generate focus-merely payments during this time period, however some loan providers can also need payments into the main. As the mark period concludes, the fresh payment several months starts, and you might build one another principal and you may notice payments. The length of so it phase varies of the financial, but can run from around 5 to 20 years.

Ideas on how to Get an effective HELOC

Protecting a home Guarantee Credit line comes to numerous procedures. From the expertise these procedures, you could potentially navigate the HELOC software process while making informed behavior.

step 1 | Gather necessary documentation

In order to begin this new HELOC software, assemble essential data such as proof money (spend stubs, taxation statements), homeownership confirmation (possessions goverment tax bill, financial statement), and identification. That have these types of data available have a tendency to streamline the program techniques.

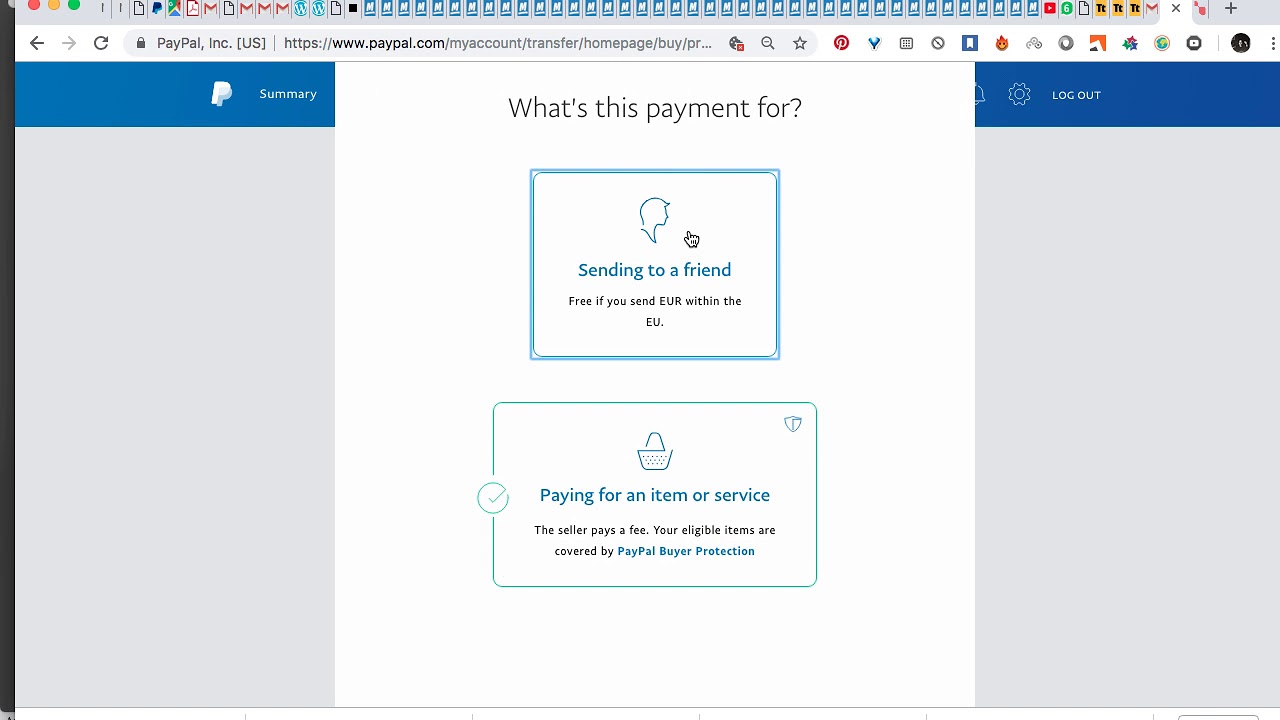

2 | Complete the application

Extremely creditors provide online apps to possess convenience, though some finance companies and you may borrowing unions like your implement from inside the-individual at the an area part. Anticipate to bring detailed information regarding your finances, assets, and you will desired HELOC terms.

step three | Waiting from the underwriting procedure

Lenders often comment the application, determine the creditworthiness, and you may be sure your income and you can property value. This process are normally taken for a home assessment to determine the home’s economy value.

cuatro | Romantic toward HELOC

Abreast of acceptance, you will get that loan arrangement discussing the fresh terms and conditions. You will need to signal the mortgage agreement and you will spend one closing costs, if relevant. A short wishing several months, constantly a few days, makes you feedback the words before financing will get energetic.

5 | Accessibility Your own HELOC

https://paydayloanalabama.com/new-brockton/

Adopting the closure techniques, you can easily gain access to your own HELOC loans. So it usually involves getting a great checkbook to have distributions, however some lenders will let you transfer the funds into the personal family savings.

Ready to open the chance of their residence’s collateral? Tradition Friends Credit Connection now offers aggressive HELOC solutions customized to the means. All of our knowledgeable mortgage brokers was right here to help you through the processes which help you will be making advised decisions. E mail us today to get the full story and start your HELOC trip.