Since your respected mortgage broker, i have usage of a varied community away from legitimate mortgage brokers inside the Atlanta. This allows us to give you numerous home loan possibilities tailored toward financial predicament and you can choice. Regardless if you are trying a conventional mortgage, government-supported loan, or certified program, The Home loan Man contains the options to discover the best complement for your requirements.

Individualized Financial Selection in Atlanta GA

We understand that each consumer’s financial situation is different. Our team at your Financial Guy enjoys the opportunity to listen and you will discover your needs, guaranteeing we make available to you home loan possibilities that make together with your long-label objectives. Our very own goal is always to secure the extremely good conditions and you may notice rates, customized particularly for your.

Streamlining the loan Procedure from inside the Atlanta

Navigating the borrowed funds techniques inside the Atlanta is daunting, but with The Home loan People with you, it becomes a mellow journey. I deal with all of the paperwork and you can talk to the lenders into the behalf, saving you efforts. All of our experts commonly direct you from the app techniques, bringing condition and you will responding any queries you have got across the ways.

Neighborhood Atlanta A property Advisor

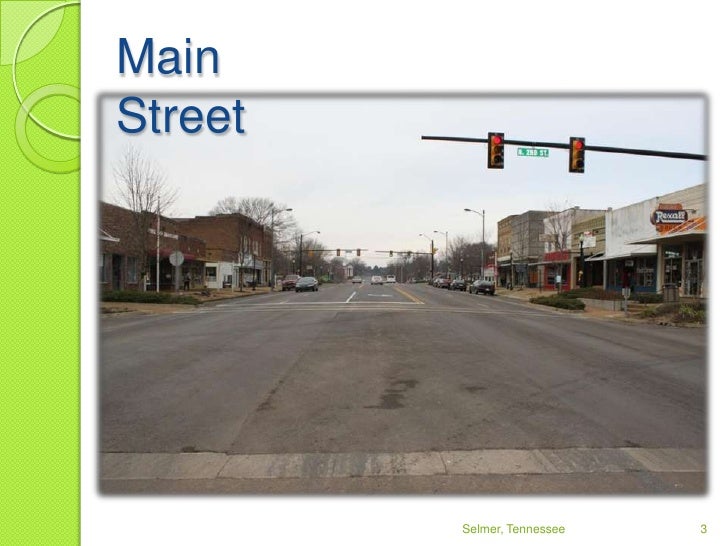

Atlanta are a district off bright areas, each featuring its own unique profile and you can life. Just like the an area large financial company, i’ve a-deep knowledge of the new Atlanta market. Whether you’re shopping for the latest busy metropolitan lifetime of Midtown, this new historic charm of Virginia-Highland, and/or loved ones-friendly suburbs, The Home loan Guy provide valuable facts in order to build informed choices.

Specialist Advice, Top Results

At the Home loan Man, we pride our selves for the bringing specialist guidance and transparent communications throughout the their mortgage trip. We need one become pretty sure and told at every step of your own procedure. Our team is always open to target the questions you have and americash loans Route 7 Gateway gives rewarding pointers, making sure you make a knowledgeable conclusion for the future house.

Speak to your Home loan People Now!

Prepared to use the first rung on the ladder towards homeownership inside the Atlanta, GA? Speak to your Home loan People right now to plan a scheduled appointment which have one to of our own educated mortgage masters. Let us become your respected companion about this enjoyable excursion, and to one another, we are going to unlock brand new doorways on the dream domestic.

You want funding choice for the a property, or other a home? Opting for a purchase mortgage product which suits your aims and you will making sure you earn an educated rate to suit your considering circumstances is feel like to play strike-a-mole.

We’re here to make the home loan process a whole lot easier, with tools and expertise that will help guide you along the way, starting with a FREE pre-recognition letter request.

We shall make it easier to certainly see differences when considering mortgage applications, enabling you to select the right one for you regardless if you are a first-go out house visitors or a skilled investor.

- Complete our simple mortgage pre-acceptance letter demand

- Receive choice based on your unique conditions and you will circumstance

- Contrast financial rates and you will terms

- Find the promote you to definitely best fits your needs

Perform We Be considered?

So you can qualify for a mortgage, loan providers normally need you to has a personal debt-to-money ratio off . This means that no more than 43% of the overall monthly earnings (of all sources, just before taxes) can go to your your new mortgage payment, and no more than % of your own monthly earnings may go to your the overall monthly financial obligation (as well as your mortgage repayment).

*Cost and you will APRs quoted significantly more than are to possess holder-occupied properties, minimal 780 credit history, restriction ninety% loan-to-well worth proportion, limitation 36% debt-to-earnings proportion. Products particularly occupancy, credit rating, loan-to-value proportion and you may loans-to-money ratio can affect your actual interest. All the condition differs. Please speak with our Signed up Financial Advisers to own a good quote particular into the facts. The maximum loan amount is actually $795,000. Example repayments considering an effective $250,000 sales speed and good $two hundred,000 amount borrowed.