Possibly, getting money that have good 550 credit rating means digging higher to possess solutions. Eg, you can look into the nonprofit otherwise regulators direction apps observe for individuals who qualify for one let. Such applications might not give you that loan or direct dollars recommendations, but they could help decrease your expenses.

Of several online lenders bring lending products you can get quickly and you can as opposed to highest-to-get to borrowing requirements. Although not, those people financial products are usually risky, and is going to be the final measure.

Cash advance to possess Low Credit scores

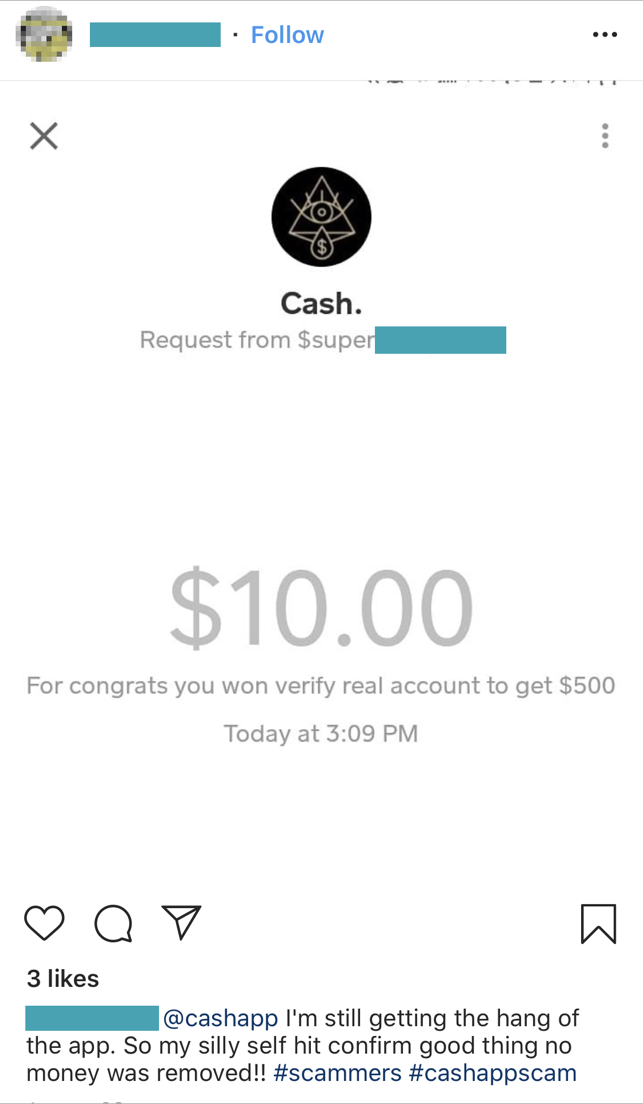

If you’re looking to own an unsecured loan having a beneficial 550 credit score, an instant payday loan must be the last resource to adopt.

Certain online lenders bring payday loan which can be an easy task to rating because they do not want one credit score and other criteria to help you meet. However, payday loan can be a very costly choice due to their exorbitant charge in addition to quick cost several months.

Certain individuals find themselves in a situation where they may be able merely afford to safeguards the interest per month, making the total cost of its financing higher still. If you are considering an instant payday loan, make sure you weighing your entire solutions prior to making good choice.

Personal lines of credit

A line of credit is a wonderful answer to access loans when you really need him or her, as much as a medication restriction. This is utilized for enough purposes, instance while making renovations, buying unexpected costs, or combining loans.

In place of having personal loans, having credit lines, you pay desire simply with the money you actually have fun with. On line lenders offer personal lines of credit to own individuals interested in individual finance having a great 550 credit history otherwise lower.

However, such lending products have a high Apr. Moreover, loan providers constantly costs an origination percentage and yearly commission, making the total cost from a credit line higher still.

Realization

Its yes you can to obtain a consumer loan with a detrimental credit rating, but it is going to more than likely come with certain downsides.

For one, you may have to shell out increased interest than just some body which have a much better credit score. Likewise, your ount.

However, you may still find selection on the market for those having smaller-than-primary credit. Just make sure to complete your search and you may compare offers before applying for money to have good 550 credit score or shorter.

Is a 550 credit rating crappy?

A great 550 credit score is terrible, but it is perhaps not the latest terrible https://paydayloanalabama.com/berry/ it is possible to. There are actions you can take to evolve their credit score, nonetheless it takes some time and effort. If you are looking getting finance with a bad credit rating and you can don’t possess for you personally to work at boosting your score, you’ve got complications providing approved for a loan. But not, discover loan providers who are experts in financing that have a great 550 borrowing from the bank get.

Just what credit score is needed getting a $2,one hundred thousand personal loan?

There’s no you to definitely-size-fits-most of the means to fix that it concern, because for each and every lender will receive a unique credit history conditions. Yet not, a rule of thumb is that you may need a credit rating of at least 580 to-be eligible for a $dos,100 consumer loan. If for example the credit rating is leaner than it, you may still have the ability to qualify for that loan, nevertheless the rate of interest are highest.

What’s the minimum rating to own an unsecured loan?

A consumer loan is a type of consumer loan, definition there isn’t any security needed to get the financing. Your credit score is one of the fundamental things you to definitely lenders glance at regarding you having a personal bank loan. The minimum credit history to have a personal loan hinges on the new bank but generally, a good credit score getting a consumer loan is normally a get out of 700 or higher. Having said that, certain lenders can get think people that have a score regarding 640 or highest getting a great fit to possess a personal loan. And think about 550? Is it possible you score a consumer loan which have a credit score from 550? The solution was yes, although mortgage terms and conditions try extremely impractical becoming favorable.